Article content

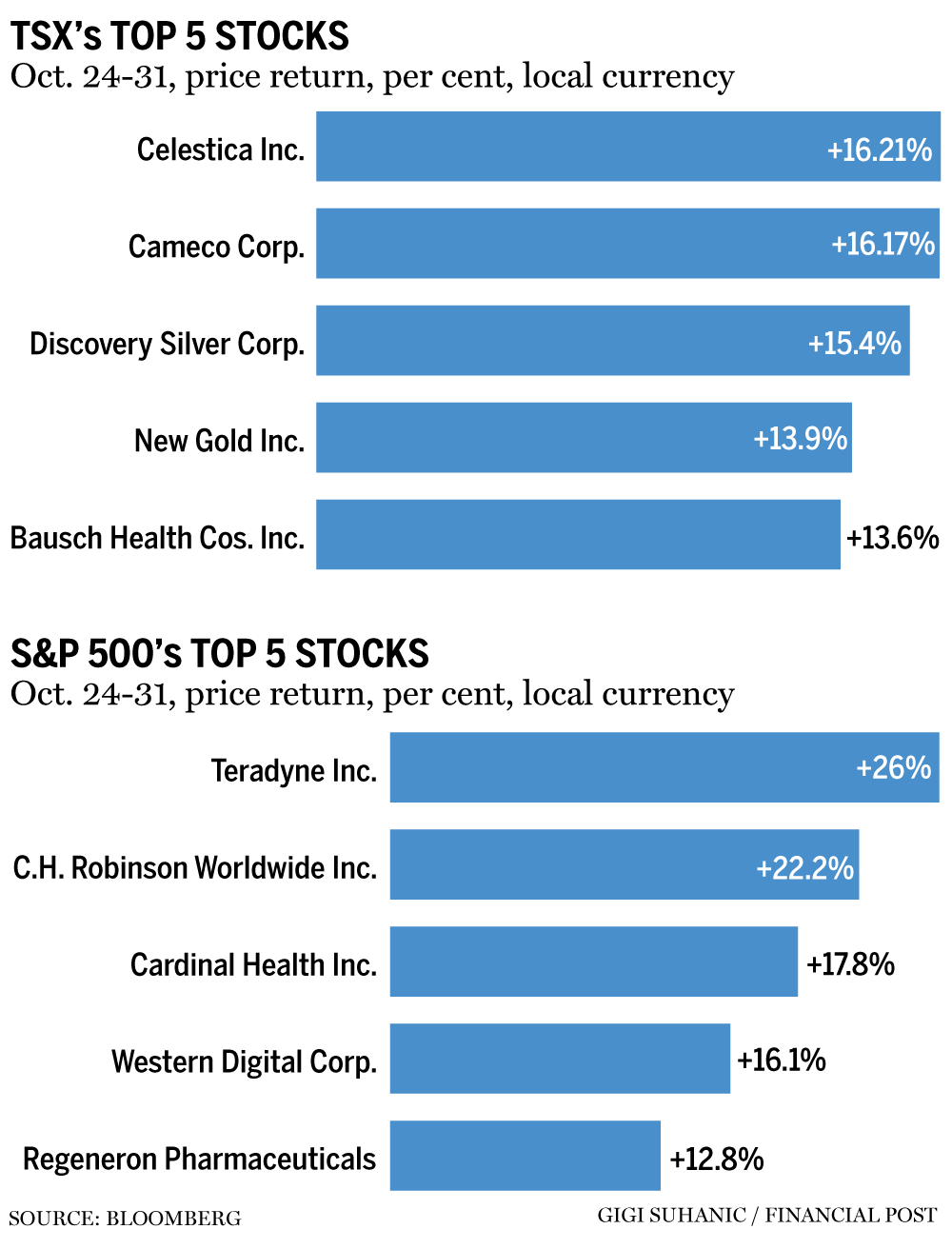

Why Amazon.com Inc. gained more than its Magnificent Seven brethren and how earnings season is unfolding for some of the TSX’s major stocks. Plus, why shares of Cameco Corp. appear unstoppable. And why this Canadian fashion retailer’s price target just got a nearly 20 per cent hike. The Financial Post explores those stories and more in The Week in Stocks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stock of the week: Amazon.com Inc.

Article content

Article content

Most of the Magnificent Seven big tech names reported earnings this week: Meta Platforms Inc. (NYSE:META), Alphabet Inc. (NYSE:GOOG), Microsoft Corp. (NYSE:MSFT), Apple Inc. (NYSE:AAPL) and Amazon.com Inc. (NYSE:AMZN). But, it was Amazon that really caught investors’ attention, with its shares up the most — nearly nine per cent on the week — compared with the other four after its cloud unit posted the strongest growth rate in almost three years. Price targets were widely increased by analysts who follow the stock, according to Bloomberg. Of the 93 analysts who track the stock, 80 rated it a buy with an average price target of US$288. Shares were trading Friday at about US$245. The Mag 7, which also includes Tesla Inc. and Nvidia Corp., account for more than one third of the S&P 500’s market cap, according to David Rosenberg of Rosenberg Research and Associates Inc. Rosenberg, in a note, aimed to dampen some of the tech-stock euphoria, warning that the “bull market is in bifurcation,” as the S&P 500 sits at the same level as six weeks ago, excluding the tech sector.

Article content

Article content

Keeping score

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

An eye on earnings and price targets for big TSX names

Article content

Many big names on the S&P/TSX composite index reported earnings this week. Here’s a sample of some the key companies followed by analysts, and what happened to their share price targets.

Article content

CIBC Capital markets raised its price target for Tim Hortons parent Restaurant Brands International Inc. (TSX:QSR) to $111.86 from $108 as analysts Mark Petrie and Chantel Pearce think the shares are undervalued compared with peers. Shares of RBI are currently trading at the $93 level. Same store sales at both Tim’s and in the international segment rose 4.2 per cent and 6.4 per cent, respectively, year over year.

Article content

CIBC also significantly hiked its price target for Celestica Inc. (TSX:CLS) to $557 from $442 on third quarter results and guidance there were progressively stronger with third quarter earnings per share (EPS) beating estimates by sever per cent and fourth quarter EPS guidance rising 15 per cent. Shares are currently trading at the $487 level. “Our view is this guidance is still ‘conservative’ given the improved visibility into GOOGL, META, AMZN, and Open AI’s capex spending plans,” Todd Coupland and Dylan Ridout said in a note. Celestica builds artificial intelligence infrastructure and has emerged as a big winner in the AI boom.

Article content

Article content

Cenovus Energy Inc. (TSX:CVO), reported earnings as it continues to work to seal its deal for MEG Energy Resources Inc. (TSX:MEG). Cenovus reported a strong quarter, Scotiabank Capital Markets analyst Kevin Fisk said in a note, as cash flow per share beat estimates and Cenovus said it was nearing completion of some major projects. Fisk maintained his price target of $29. Shares are currently trading at the $24 level.

Article content

Article content

Canadian National Railway Co. posted a “modest” earnings per share beat that was mostly cost-driven “in an ongoing weak macro (environment),” TD Cowen analyst Cherilyn Radbourne said in a note. CN also repurchased about $1 billion worth of shares. TD maintained its price target of $165. Shares are currently trading around $134.

Article content

Cameco on a tear

Article content

Cameco Corp. (TSX:CCO) earned several price target hikes on news of a US$80 billion nuclear reactor deal between the U.S. government and Westinghouse Electric Co., which Cameco jointly owns with Brookfield Asset Management LP. Price hikes flowed in from Scotiabank Capital Markets, National Bank of Canada Financial Markets, Goldman Sachs Group Inc. and Raymond James. Scotiabank raised its price target to $150 from $130, while National Bank hiked its target to $140 from $130. Shares of Cameco are trading at the $150 level. National Bank analyst Mohamed Sidibe said the deal allows for eight reactors to be built where previously only four had been anticipated.

.jpg) 8 hours ago

3

8 hours ago

3

English (US)

English (US)