Article content

After years of leading the stock market, Nvidia Corp.’s wild rally took a break over the summer. Now Wall Street is looking for some D.C. magic to get the shares running again.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

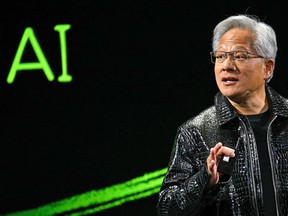

The chip giant’s three-day artificial intelligence conference called “GTC” began Monday in the United States capital, and all eyes will be glued to the keynote address by chief executive Jensen Huang scheduled for midday Tuesday. While GTC events have been held in Washington before, this is the first one to feature a keynote from the CEO. And some investing pros see the location as significant.

Article content

Article content

Article content

“GTC is sort of the AI Super Bowl,” said Gerry Sparrow, who oversees about US$120 million as chief investment officer of the Sparrow Growth Fund, which owns Nvidia shares. “The fact that it’s in D.C. could be foreshadowing that something good will be announced.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

On Tuesday, President Donald Trump said he wants to congratulate Huang, although it was not immediately clear if this was for anything specific. Speaking during remarks to business leaders in Tokyo, he also said he will meet with the Nvidia CEO tomorrow. Shares of Nvidia moved higher, rising 0.5 per cent before the opening bell.

Article content

Not too long ago, a catalyst was the last thing Nvidia shares needed, as AI fever captured the market and placed the chipmaker at the centre of the boom. The stock has been among the best performers in the S&P 500 Index in every year since 2022, and this year it was up 32 per cent through the end of July. But since then it has gone from a sprint to a jog, rising 7.7 per cent while the rest of the chip industry races ahead, with the Philadelphia Semiconductor Index jumping 28 per cent, as of its last close.

Article content

Article content

Intel Corp. has been the big winner in the last three months, soaring more than 100 per cent on the strength of a massive capital infusion that includes US$8.9 billion from the White House in return for a 10 per cent stake in the company. The shares were down roughly one per cent through July this year. AI rivals Broadcom Inc., Applied Materials Inc. and Arm Holdings PLC are also far outpacing Nvidia since the start of August. And on Monday, Qualcomm Inc. climbed 11 per cent, reaching its highest level since July 2024, after unveiling AI chips aimed at challenging Nvidia.

Article content

Article content

Article content

China has been a major overhang for Nvidia. In August, the company and AMD agreed to a controversial deal that gives the U.S. government 15 per cent of their revenues from Chinese AI chip sales. Over time, greater access to the Chinese market could add 10 per cent to Nvidia’s roughly US$4.7 trillion market capitalization, according to Sparrow. So with President Donald Trump in Asia this week and scheduled to meet with China President Xi Jinping on Thursday, investors are looking for something that will galvanize the stock again.

.jpg) 9 hours ago

3

9 hours ago

3

English (US)

English (US)