Article content

(Bloomberg) — Lloyds Banking Group Plc has set up a desk to help clients buy and finance carbon offsets, as it moves into a market that’s seen a retreat by peers including HSBC Holdings Plc.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

London-based Lloyds named Emily Martin its head of voluntary carbon and nature markets earlier this year, according to her LinkedIn page, which was confirmed by a spokesperson at the bank. Martin will help corporate and institutional clients in the voluntary carbon and nature markets, her LinkedIn profile shows.

Article content

Article content

Lloyds also named Gabriella Carden to lead its carbon and nature markets strategy across the bank’s markets business, according to LinkedIn and confirmed by a spokesperson for the bank. Both Martin and Carden have worked at Lloyds for more than 10 years in a range of roles spanning fixed income, commodities and sustainability.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

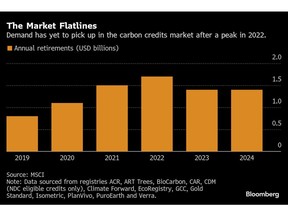

The development shows major banks continue to be interested in the voluntary carbon market, despite a decline in recent years amid a series of greenwashing scandals. HSBC shelved plans to build a desk to trade credits and help finance project developers, Bloomberg reported in November. And Shell Plc has been looking to sell part of its portfolio of nature-based carbon projects.

Article content

A carbon credit represents one metric ton of CO2 that’s been avoided, reduced or removed from the atmosphere. Banks trade the credits, finance projects that produce them, and often use them to offset their own carbon footprints. Many large corporations have climate targets for 2030 and 2050 that rely on such credits. By investing now, companies are betting future demand will coincide with a shortage in supply.

Article content

Article content

Demand from heavy-emitting sectors alone may reach 7 billion metric tons of CO2 in 2050, up from 171 million today, according to BloombergNEF.

Article content

In Lloyds’ home market, the government has identified voluntary nature and carbon markets as part of Britain’s clean growth strategy, and is pushing for London to become a global hub. The UK government also is working on incorporating carbon-removal credits into its regulated emissions trading system, a development that’s planned to take effect in “the early 2030s,” Felix Grey, policy team leader at the UK Department for Energy Security and Net Zero, said at the Innovation Zero conference in London last month.

Article content

Nature markets, which the UK government defines as mechanisms for the trading of credits of an environmental output or outcome, are even more nascent. Britain set a goal to increase annual private investment flows to nature to more than £1 billion ($1.3 billion) every year by 2030 in England. Last year, King Charles III signed over part of his Sandringham Estate, where a private company will restore land and create tradable biodiversity credits. So far, just a handful of voluntary nature credit trades has been completed globally.

Article content

The carbon and nature markets desk at Lloyds’ sits within its sustainability and client advisory team, which was started in 2021 and now comprises about 35 people, according to a spokesperson for the bank. The team’s purpose is to support some of Lloyds’ largest clients with their sustainability objectives, they said.

Article content

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)