Article content

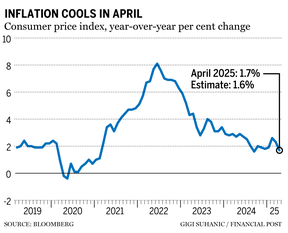

Headline inflation slowed in April mainly due to drop in gasoline prices because of the elimination of the federal carbon tax, but it was a different story for the measures the Bank of Canada follows.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Statistics Canada said Tuesday the main reading on the consumer price index (CPI) decelerated to 1.7 per cent year over year just ahead of analysts’ estimates of 1.6 per cent and down from 2.3 per cent in March.

Article content

Article content

Gas prices fell 18.1 per cent in April, also helped by lower oil prices, pushing the overall inflation rate below the Bank of Canada’s two per cent target for the first time since January.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

However, the central bank’s preferred measures — core CPI median and trim, which strip out the effects of taxes — accelerated to 3.2 per cent and 3.1 per cent year over year from 2.9 per cent and 2.8 per cent, respectively.

Article content

April’s results boost those measures above the top end of the Bank of Canada’s inflation target range of three per cent.

Article content

Here’s what economists think the numbers mean for the central bank and its upcoming interest rate decision on June 4.

Article content

Article content

‘Bit of a box’: Rosenberg Research

Article content

“The Canadian inflation numbers for April were hotter than expected, which comes as a surprise to a wobbly economy replete with employment loss and widening spare capacity in the labour market,” David Rosenberg, founder of Rosenberg Research and Associates Inc., said in a note, pointing to the pickup in core inflation.

Article content

Rosenberg also said “it was disappointing” to see a jump in the core reading that excludes food and energy, which has risen in four of the past five months.

Article content

Article content

The “staycation” trend was the main source of the underlying increase in inflation as travel services rose 8.7 per cent in April month over month. Recreation services and restaurants also benefited from the stay-at-home movement.

Article content

Article content

“This places the Bank of Canada in a bit of a box,” he said.

Article content

‘Strain on the economy’: Capital economics

Article content

The latest CPI data shows that “underlying inflation pressures still pose a threat,” said Thomas Ryan, North America economist with Capital Economics Ltd.

Article content

Stripping out gasoline, the rate of inflation stepped up to 2.9 per cent year over year from 2.5 per cent.

Article content

Prices rose for airfares, motor vehicles, with the latter taking a hit from retaliatory tariffs — and food prices.

Article content

“While this level of underlying inflation is still too high for the Bank of Canada’s comfort, the bank’s mostly dovish tone in April suggests it is more focused on economic risks,” Ryan said.

Article content

Capital thinks the Bank of Canada will cut its rate again in June after pausing in April because weak employment and housing data point to “growing signs that U.S. tariffs are putting strain on the economy.”

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)