Article content

(Bloomberg) —

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Article content

Article content

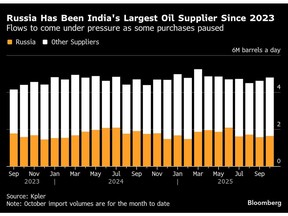

Indian refiners accounting for more than half of the nation’s imports of Russian crude have paused buying for the coming months, reinforcing expectations purchases for December and January delivery will plunge.

Article content

Article content

Indian processors, the top buyers of seaborne oil from Moscow, have been weighing up their options since US authorities blacklisted two of Russia’s largest producers, Rosneft PJSC and Lukoil PJSC, last week. Now they are preparing for a lengthy hiatus.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Top importer Reliance Industries Ltd., which has a long-term supply contract with Rosneft signed only months ago, will no longer take Russian cargoes, according to a person with direct knowledge of its plans, who asked not to be identified as the information is private. The conglomerate was already grappling with an incoming European Union ban on fuels made from Moscow’s oil.

Article content

Mangalore Refinery and Petrochemicals Ltd., one of the smaller state-owned entities, said it paused all buying for now, citing the risk of secondary sanctions. HPCL-Mittal Energy Ltd., a joint venture between tycoon Lakshmi Mittal’s Mittal Energy and Hindustan Petroleum Corp. Ltd., suspended further deals.

Article content

Combined, the three accounted for about 920,000 barrels a day of Russian crude imports in the first half of the year — or 52% of India’s total, according to data from analytics firm Kpler. That will now likely fall to zero, though the figure could change over time as other factors, including sanctions enforcement and the evolution of India’s trade talks with the US, become clearer.

Article content

Article content

In the meantime, refiners are moving to fill the gap left by Moscow. Reliance went on an oil-buying spree last week, picking up at least 10 million barrels of Middle East and US cargoes to make up for the shortfall. MRPL purchased spot crude from Abu Dhabi.

Article content

State-owned Indian Oil Corp. said earlier this week that the company was “absolutely not going to discontinue” purchases of Russian crude, but would comply with international sanctions. Bharat Petroleum Corp., another state-owned refiner, also expressed interest in buying some Russian crude in the current trading cycle.

Article content

Still, IOC has since sought as much as 24 million barrels of crude from the Americas in a term contract.

Article content

On Friday, state-owned Hindustan Petroleum Corp. said it has also stopped processing Russian crude, citing reasons over economic viability, according to comments from Chairman Vikas Kaushal on an analysts’ call. The refiner is now processing more Middle East and West African barrels instead.

Article content

Moves by India’s state and private refiners have been scrutinized over the past weeks as traders look for changes in behavior after the wave of new European and US restrictions on Russia. India, walking a geopolitical tightrope, has typically been more wary of violating Western sanctions than China.

Article content

Reliance, MRPL, IOC and BPCL did not respond to requests for comment.

Article content

The availability of Russian crude sold by unsanctioned companies is now in focus, along with arrivals from the blacklisted firms that are transferred to or marketed by other smaller entities. Last year, Rosneft, Lukoil PJSC, Surgutneftegas PAO and Gazprom Neft PJSC — all now sanctioned — supplied more than 80% of India’s imports, according to Kpler.

Article content

(Updates to add HPCL comments in ninth paragraph)

Article content

.jpg) 7 hours ago

2

7 hours ago

2

English (US)

English (US)