Article content

(Bloomberg) — Lea en español

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Oil steadied as traders weighed impending OPEC+ talks to decide on whether to boost output again against reports that the US plans military strikes on OPEC producer Venezuela.

Article content

Article content

West Texas Intermediate climbed as much as 1.3% before surrending most of those gains on Friday. The Trump administration identified targets in Venezuela that include military facilities used to smuggle drugs, the Wall Street Journal and The Miami Herald reported, citing US officials and people familiar with the matter.

Article content

Article content

Traders had mostly priced in the prospect of curtailed flows from Caracas after Trump deployed naval assets to the Carribean. Additionally, it’s unlikely that a military campaign would target energy assets, market participants say. The escalation is happening against a backdrop of a looming worldwide crude glut.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“If the US intention is regime change, there is a vested interest in keeping energy infrastructure more or less intact, as that would provide financial support for whatever government succeeds Maduro,” said Gregory Brew, a geopolitical analyst at the Eurasia Group.

Article content

Even so, a potential military clash stands to impact major economies from China and India to Western Europe, and may complicate business for US Gulf Coast refiners that rely on Venezuelan heavy crude to feed production lines. The South American nation sent 126,000 barrels per day to the US in September, according to Kpler and US Customs data compiled by Bloomberg.

Article content

Meanwhile, traders continue to assess the potential impact of US sanctions on Russia’s two largest oil producers — something that the boss of Europe’s largest oil refiner said the market was under-appreciating. Processors accounting for more than half of India’s imports of Russian crude have paused buying for the coming months.

Article content

Article content

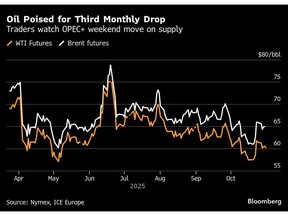

Oil prices were down earlier in the session as traders refocused on an upcoming OPEC+ meeting. A third monthly output increase of 137,000 barrels a day would be the base case for the forthcoming OPEC+ talks, delegates said earlier this week, matching market expectations.

Article content

WTI crude has fallen more than 15% this year as increased supply from both within and outside of the Organization of the Petroleum Exporting Countries and its allies outstrips demand growth.

Article content

OPEC+ has already restored one tranche of curbed supplies, amounting to 2.2 million barrels a day, a year ahead of schedule. The group has adopted a more careful pace with the subsequent layer of additions, waiting to see how the market develops.

Article content

While crude markets are wrestling with oversupply, there’s been strength in refined fuels, particularly after US sanctions on Rosneft and Lukoil. Diesel prices are at their biggest premiums to crude since early 2024, bolstering refining margins which can in turn boost demand for crude.

Article content

—With assistance from John Deane.

Article content

.jpg) 7 hours ago

3

7 hours ago

3

English (US)

English (US)