Article content

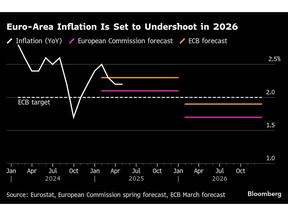

(Bloomberg) — Euro-area inflation will fall below the European Central Bank’s target next year because of fallout from US trade policies, according to the European Commission.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Consumer-price growth will slow to the 2% goal by the middle of this year and average only 1.7% in 2026, the EU’s executive arm said in its spring forecast released on Monday. Downward pressures including lower energy costs, the diversion of Chinese goods and a stronger euro are having a “clearly negative” impact, the commission said.

Article content

Article content

Economic expansion is seen picking up to 1.4% next year from 0.9% in 2025, a slightly more optimistic view compared to the last ECB forecast in March and the International Monetary Fund’s global outlook in April. Brussels officials see uncertainty weighing on domestic demand, but labor markets staying robust.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Inflation is declining faster than previously forecast and is on track to reach the 2% target this year,” European Economy Commissioner Valdis Dombrovskis said. “But we cannot be complacent. The risks to the outlook remain tilted to the downside, so the EU must take decisive action to boost our competitiveness.”

Article content

The ECB will present its own set of quarterly forecasts alongside its next rate decision on June 5. Investors are expecting another reduction in borrowing costs, with many policymakers sharing the view that US tariffs will put downward pressure on prices.

Article content

Uncertainty about how policies evolve is high. Most euro-zone exports to America are subject to a 10% tariff during a 90-day negotiation period. The EU is seeking to secure favorable terms in these talks, but it has also prepared a list of products to hit with counter-levies should discussions fail.

Article content

Article content

The EU’s forecasts assume that US tariffs remain at 10%, with higher duties on some products and exemptions on others, and used a cut-off date of April 30 for other inputs. Some de-escalation between the US and China was expected, but with duties remaining at a higher level than what was announced on May 12.

Article content

The two nations agreed to temporarily slash tariffs to allow for talks after previously raising them to prohibitive levels. The tensions have raised the threat that a large amount of Chinese products get rerouted to the euro zone, intensifying competition and driving down prices.

Article content

“Given the magnitude of these flows, this is set to markedly increase competitive pressures in consumer goods markets across the EU,” the commission said. Together with the appreciation of the euro, this should push goods inflation down to close to 0% in the euro area, it said.

Article content

Services costs have remained more elevated, mostly due to robust wage growth. It’s expected to slow “only gradually” to 2.5% toward the end of 2026.

Article content

The situation presents a challenge to the ECB, which has to weigh the disinflationary impacts from tariffs in the short term against the longer-term effect from disrupted supply chains and higher fiscal spending in Europe. Many policymakers are wary of taking interests much lower and into territory where they’d boost economic activity.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)