Article content

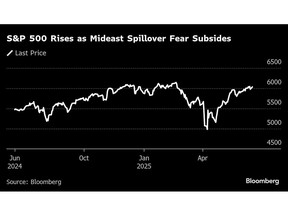

(Bloomberg) — Asian stocks are poised for a cautious open as fears subsided that Israel’s war against Iran would escalate into a wider conflict, with reports that Tehran wants to restart talks over its nuclear program.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Equity futures pointed to small gains in Tokyo and Hong Kong, and a flat open in Sydney, as risk-on sentiment returned to Wall Street on Monday and pushed the S&P 500 up about 1%. Oil continued to decline in early Asia trading on signs that the conflict in the Middle East may avoid disrupting crude production.

Article content

Article content

Article content

There were mixed signs that investors will keep faith in the US economy, as longer-maturity Treasuries continued to lag the market even after a $13 billion sale of 20-year bonds drew the expected yield level — a notable improvement from last month’s auction disappointment that spurred a broad selloff. The dollar was little changed.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

President Donald Trump said Iran wants to talk about de-escalating the conflict with Israel even as the two sides exchanged fire for the fourth consecutive day. Asked if the US would get more involved militarily, the US leader said he didn’t want to discuss it.

Article content

Tehran is signaling it wants to de-escalate hostilities with Israel and is willing to resume nuclear talks with the US as long as Washington doesn’t join the Israeli attacks, the Wall Street Journal reported Monday citing Middle Eastern and European officials it didn’t identify. A similar report by Reuters says Iran conveyed the message through Qatar, Saudi Arabia and Oman.

Article content

The outbreak of hostilities between Israel and Iran disrupted the momentum that had driven the S&P 500 back near record levels. While markets initially adopted a cautious, risk-off stance to assess how the conflict might unfold, sentiment improved on Monday as investors speculated the attacks were unlikely to draw in more parties.

Article content

Article content

“Focus will remain on geopolitical headlines, but as long as the conflict stays limited between Israel and Iran, it’s unlikely to materially impact the markets,” said Tom Essaye at The Sevens Report.

Article content

Investors in Asia will be keeping an eye on the Group of Seven summit in Alberta, Canada, where Trump met with Japanese Prime Minister Shigeru Ishiba on Monday. Tokyo is seeking a full removal of tariffs imposed by the US, including a 25% levy hitting crucial auto industry exports. Without a deal, the world’s fourth-largest economy could tip into a technical recession.

Article content

The mood in China was boosted on Monday as data showed unexpectedly strong retail sales in May gave the economy some relief from US tariffs. Still, the momentum may not last as deflationary forces persist and a housing market slump shows signs of deepening.

Article content

Despite the calmer market sentiment, the Middle East remains tense. Israel launched an attack on the South Pars gas field, forcing the halt of a production platform, following strikes on Iran’s nuclear sites and military leadership last week. However, critical crude oil-exporting infrastructure has so far been spared and there’s been no blockage of the vital Strait of Hormuz.

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)