Article content

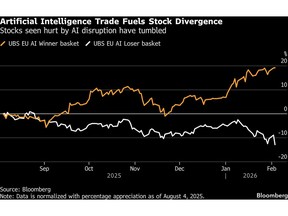

(Bloomberg) — Once again, artificial intelligence is dominating investors’ attention in the stock market. These days, however, the focus is turning more and more toward companies that may get disrupted by the new technology rather than those who stand to profit from it.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A Goldman Sachs basket of US software stocks sank 6% on Tuesday, its biggest one-day decline since April’s tariff-fueled selloff, as a new AI automation tool from Anthropic PBC heightened concerns about the business prospects for some companies. The Nasdaq 100 Index fell 1.6%, trimming a drop of as much as 2.4%.

Article content

Article content

Article content

The first wave of selling was in stocks associated with legal and data services technology, with most of the software sector and much of the financial-technology sector eventually being dragged lower in their wake. Shares of business development companies and Wall Street’s largest alternative-investment firms were also punished as concerns over the group’s widespread exposure to software intensified.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“This year is the defining year whether companies are AI winners or victims, and the key skill will be in avoiding the losers,” said Stephen Yiu, CIO of Blue Whale Growth Fund. “Until the dust settles, it’s a dangerous path to be standing in the way of AI.”

Article content

The selloff started before the US market opened, with credit and marketing services company Experian Plc, business and legal software maker RELX PLC and the London Stock Exchange Group Plc. posting steep losses in London.

Article content

Thomson Reuters Corp. and Legalzoom.com Inc. were among the worst performers in the US and Canada, pushing the iShares Expanded Tech-Software Sector ETF down 4.6% in its sixth consecutive day of declines. The ETF is coming off a 15% plunge in January, its worst month since 2008.

Article content

Article content

“Anthropic launched new capabilities for its Cowork to the legal space, heightening competition within the space,” Morgan Stanley analysts including Toni Kaplan wrote in a note on Thomson Reuters, the provider of business and legal information. “We view this as a sign of intensifying competition, and thus a potential negative.”

Article content

Shares of business development companies were caught in the selling, with Blue Owl Capital Corp. falling as much as 13% for a record ninth-straight decline that dragged the stock to the lowest since 2023. Fears of disruption have rattled credit globally, sending software loans in the broadly syndicated market lower last week. As publicly traded entities, BDCs provide a real-time window into the otherwise opaque direct-lending market.

Article content

Ares Management Corp., KKR & Co. and TPG Inc. each fell by more than 10% at one point, while Apollo Global Management Inc. and Blackstone Inc. dropped by as much as 8%.

Article content

Anthropic is part of a rash of AI startups developing tools for the legal industry. Long before Anthropic’s plugin, startups including Legora and Harvey AI were flooding the legal industry with tools they say will save lawyers from grunt work. Investors have been pouring money into AI products for the legal industry for more than two years. Harvey AI was valued at $5 billion in June, and Legora raised funds at a $1.8 billion valuation in October.

.jpg) 1 hour ago

1

1 hour ago

1

English (US)

English (US)