Article content

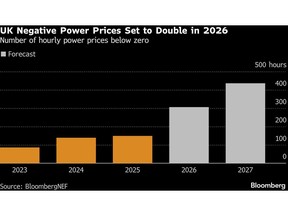

(Bloomberg) — Instances of negative power prices in Britain are set to more than double this year as renewable generation expands faster than electricity demand.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The trend reflects the speed of renewable expansion. A record 7.4 gigawatts of new wind and solar capacity is due to come online in the UK this year, BloombergNEF estimates, including RWE AG’s 1.4-gigawatt East Anglia 3 offshore wind farm. Electricity consumption, meanwhile, is expected to remain largely flat.

Article content

Article content

Article content

That squeezes revenue for renewable developers — but it’s opening up fresh opportunities for battery operators that can store excess electricity and sell it back later.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Britain is on track for 306 hours of negative pricing this year, up from 149 in 2025, according to BloombergNEF. That would be the sharpest annual increase since 2022. In Germany, Europe’s largest power market, negative-price hours are expected to jump by 57%.

Article content

Prices plunge below zero when surging output from wind and solar farms overwhelms the grid and there isn’t enough consumption to absorb the power.

Article content

Extreme weather can exacerbate the problem. When Storm Amy swept across the British Isles, gusts exceeding 90 miles per hour flooded the network with wind energy and resulted in as many as 14 hours of prices below zero on Oct. 4, according to data from the European Energy Exchange SE.

Article content

In theory, such episodes mean consumers should get paid to use electricity. In practice, only a small minority of European households and businesses have contracts flexible enough to track wholesale prices hour by hour.

Article content

Article content

For renewable developers, more frequent negative prices add a new layer of risk. Under the UK’s contract-for-difference subsidy program, generators receive top-up payments when prices fall below an agreed level — but those payments stop entirely when prices turn negative.

Article content

Read: Why Power Prices Can Go Negative and What It Means: QuickTake

Article content

To compensate, bidders in the latest offshore wind subsidy auction added roughly £5 ($6.9) per megawatt-hour — about an 8% premium — to strike prices, according to Duncan Steen, a director at consultancy Baringa Partners. That additional cost ultimately feeds through to consumer bills.

Article content

“Developers need to account for that exposure by bidding at a higher CfD,” Steen added.

Article content

At the same time, negative prices are creating opportunities for battery storage operators. By absorbing excess electricity during periods of oversupply and releasing it when prices rebound, batteries help smooth price swings and reduce volatility.

Article content

The sector is expanding rapidly. BloombergNEF expects 9.8 gigawatt-hours of battery capacity to be commissioned in the UK this year — more than has been built in total since the technology began scaling up around a decade ago. Grid connection delays are holding back even more projects, Steen said.

Article content

Investors are taking notice. Joshua Murphy, head of storage at Econergy Renewable Energy Ltd., said the industry has reached a “tipping point,” with banks increasingly viewing batteries as infrastructure-style assets rather than speculative bets.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)