Article content

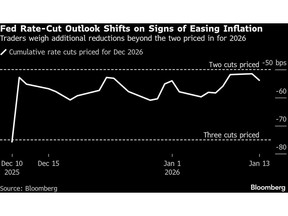

(Bloomberg) — Bond traders’ expectations were bolstered for the Federal Reserve to lower interest rates by mid-year after a weaker-than-expected US inflation reading.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Interest-rate swaps showed traders saw no chance the Fed will lower rates at their policy meeting later this month, though they fully priced in a reduction by June. Treasuries, which initially rallied after Tuesday’s data, failed to sustain the positive reaction as investors looked ahead to an auction of 30-year bonds later in the session.

Article content

Article content

Article content

The inflation data was “a mixed picture” and “the Fed will have to parse this,” Tiffany Wilding, an economist at Pacific Investment Management Co., told Bloomberg Television. “After 75 basis points of cuts at the past three meetings,” she said that Fed officials “are pretty comfortable pausing here.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Tuesday’s inflation release marks a return to greater normality after the extended US government shutdown last year distorted the readings for October and November. The core consumer price index, excluding the often volatile food and energy categories, increased 0.2% from November, compared with economists’ median forecast of 0.3%. On an annual basis, it advanced 2.6%, matching a four-year low.

Article content

The report offers evidence that inflation is trending downward, reinforcing expectations the Fed can further lower rates this year. After three rate cuts by the central bank since September, traders see the next reduction by June, with another to follow in the fourth quarter.

Article content

“Our take was that as inflation has taken a back seat to the employment figures, today’s data was unlikely to shift the January Fed pause pricing. That appears to be the market’s response,” wrote Ian Lyngen, head of US rates strategy at BMO.

Article content

Article content

The outlook for Fed rate cuts this year has been contentious by recent standards because inflation remains higher than the central bank’s 2% target despite some signs of weakness in the job market. Two Fed officials dissented from the December rate cut in favor of no action, while one favored an even larger reduction.

Article content

After data on Friday showed an unexpected drop in the US unemployment rate in December, a number of big Wall Street banks — including Morgan Stanley, Barclays and Citigroup — pushed their forecasts for the Fed’s rate cuts later into 2026. Strategists and economists at JPMorgan Chase & Co., meanwhile, said they no longer expect a cut at all this year and see a rate hike next year.

Article content

On Tuesday, two-year Treasury yields at around 3.55% were the highest in several weeks ahead of the inflation report. Short-term notes, which are most sensitive to monetary policy, briefly rallied on Tuesday immediately after the report, with two- and five-year yields falling as much as about 3 basis points. As of 9:05 a.m. New York time, two- and five-year yields were nearly unchanged on the day.

Article content

“It should be encouraging to markets for sure,” said Jan Nevruzi, a strategist at TD Securities. “I don’t think it changes the math for January at all as the last labor market data sealed that skip.”

Article content

—With assistance from Michael MacKenzie, Carter Johnson, Alice Gledhill and Kristine Aquino.

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)