Article content

Desjardins’s 2026 top picks, food inflation winners and more stories from The Week in Stocks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

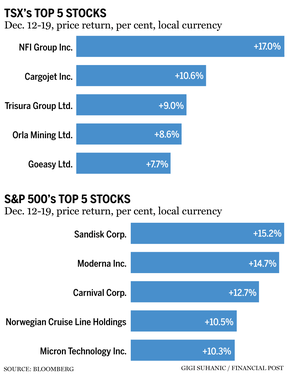

Stock of the week: NFI Group Inc.

Article content

Article content

Transit bus maker NFI Group Inc. (TSX:NFI) rose 17 per cent this week, reversing a recent decline in shares after the Winnipeg-based company announced a new chief executive and a settlement regarding a battery recall. Shares closed up 12 per cent on the news and continued to climb from there, though they gave back some gains on Friday. It has been a year of split fortunes on the S&P/TSX composite index for NFI. Shares had risen nearly 47 per cent through July before retracing most of those gains — until Monday’s rebound. Analysts believe there is more potential upside to come. CIBC Capital Markets’ Krista Friesen said in a note in early November that despite the recall, the company has “solid fundamentals.” With a backlog of $13.2 billion in orders, “we maintain confidence in NFI’s ability to deliver growth and margin improvement heading into 2026.” CIBC has a price target of $20 on shares of NFI. The average 12-month price target is $20.83, according to six analysts tracked by Bloomberg. Shares closed Friday at $15.37.

Article content

Article content

Keeping score

Article content

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Carney major projects winner garners bank coverage interest

Article content

Nouveau Monde Graphite Inc. (TSX:NOU) just landed on a second major bank’s coverage list after the miner of the critical mineral graphite was referred to Mark Carney’s Major Projects Office (MPO). The company will help accelerate the construction in Quebec of a graphite mine to be paired with a battery material plant. BMO Capital Markets started covering Nouveau Monde this week, with metal and mining analyst Raj Ray setting a price target on the shares of $6 and an outperform rating. Nouveau Monde is currently trading around $3.50. In a note, Ray noted offtake agreements for approximately 100 per cent of production and 80 per cent of production subject to a floor price. Graphite is used in defence, battery storage and electric vehicle applications. National Bank Capital Markets started covering Nouveau Monde in November and has a price target of $5.25. National is projecting construction of the mine and possibly the plant to begin in mid-2026. “Overall, we view this update (referral to the MPO) as a positive for (Nouveau Monde) with government support improving odds of the project becoming reality,” analyst Mohamed Sidibe said in a note.

Article content

Article content

Article content

The food inflation winner

Article content

Statistics Canada confirmed what Canadians already know — that the cost of food continues to rise — as November inflation numbers for food purchased at stores rose 4.7 per cent year over year compared with a 2.2 per cent increase in the overall consumer price index (CPI). That can benefit grocers, with some better placed than others. “The food CPI backdrop continues to favour grocers with (a) strong value proposition and (is) likely to keep shaping consumer shopping patterns,” Irene Nattel, RBC Capital Markets retail analyst, said in a note. With consumers in permanent deal-hunting mode, Loblaw Cos. Ltd. (TSX:L), which was one of RBC’s best ideas for 2026, is best placed to come out on top, Nattel said. RBC has a price target for the shares of $68. Loblaw traded Friday near $62. Among the chain’s “key levers” are its ability to expand its “hard discount” square footage, she said.

Article content

Some top picks for 2026 from Desjardins

Article content

Desjardins Research put out a fresh list of top picks for the new year. Here’s a look at a few, by sector, and why analysts think they will perform for investors. Consumer staples/discretionary: Desjardins’s top idea is Gildan Activewear Inc. (TSX:GIL). It has a price target on the Montreal company of $95. Shares traded Friday at $87.48. Gildan is on Desjardins’s radar due to the possibility of a greater than 20 per cent compound annual growth rate in the earnings per shares (EPS) over three years, plus “controllable” EPS and the expected sale of HBI Australia, which would allow for share buybacks sooner than later. Financial Services: Canadian Imperial Bank of Commerce (TSX:CM) is the top pick in this sector. Desjardins has a price target on CIBC of $135. It closed Friday at $130.70. CIBC “has been rebranded as the bank of ‘no surprises.’ As we look forward, we do not expect any material change to CM’s strategy under its new CEO,” Desjardins said in its report, adding it thinks the Big Six player deserves a “premium multiple” on expectations that it will deliver next year on net interest margin, expenses, credit and buybacks. Metals and mining: Torex Gold Resources Inc. (TSX:TXG) is the top pick in this hot sector that was responsible for a good chunk of the TSX’s gains in 2025. Desjardins has a price target of $90. Shares closed Friday at $66.77. Torex made the cut based on the recent on-time and “nearly” on-budget completion of a new mine in Mexico, the purchase of Reyna Silver and the miner’s expected debt-free status in the first quarter of 2026, Desjardins said.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)