Article content

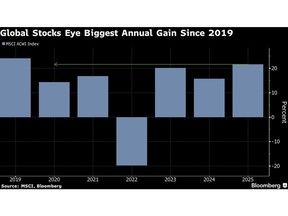

(Bloomberg) — Stocks posted modest gains in Asia as the year-end rally extended, while gold and silver advanced to records. Trading was thin as a number of the region’s markets remained shut for holidays.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

MSCI’s regional stock gauge rose for a sixth day after US shares closed at a record high on Wednesday before the Christmas break. Treasuries edged lower in Asia with the yield on the benchmark 10-year climbing one basis point to 4.15%. A gauge of the dollar was little changed.

Article content

Article content

Article content

Gold and silver jumped as escalating geopolitical tensions and dollar weakness helped extend a historic rally for precious metals. Spot silver advanced for a fifth straight session, climbing as much as 4.5% to cross $75 an ounce for the first time. Gold, set for its best annual advance since 1979, rose as much as 1.2% to above $4,500 an ounce.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Equity bulls are pinning their optimism on what’s known as the “Santa Claus Rally” to push stocks to fresh records even as exuberance over artificial intelligence and the Federal Reserve’s interest-rate path are being questioned. The rally is traditionally seen as taking place on the final five trading sessions of a year and the first two of the new one.

Article content

“As equity markets enter the fourth year of a bull market, our underlying market call remains constructive,” Scott Chronert, head of US equities strategy at Citigroup Inc., wrote in a note this week. “The current fundamental backdrop clearly has the opportunity for an ongoing AI-related tailwind to large-cap growth.”

Article content

The S&P 500 Index gained for a fifth day Wednesday in a shortened session ahead of the Christmas holiday. The VIX index of the S&P 500’s expected volatility fell to the lowest this year.

Article content

Article content

Elsewhere, oil headed for the biggest weekly gain since late October, as traders tracked a partial US blockade of crude shipments from Venezuela and a military strike by Washington against a terrorist group in Nigeria.

Article content

The yen fell 0.3% to trade at about 156.29 to the dollar after Tokyo’s inflation cooled more than expected as pressures from food and energy prices faded. That triggered weakness in the currency on bets the Bank of Japan may delay the timing of its next rate hike.

Article content

A key move on Thursday was China’s yuan strengthening past the psychological milestone of 7 per dollar in offshore trading for the first time since September 2024. Gains have been driven by speculation the central bank will allow gradual currency appreciation to boost market confidence.

Article content

That came after the People’s Bank of China strengthened its daily reference rate to the strongest level since September 2024.

Article content

Corporate News:

Article content

- Nvidia Corp. agreed to a licensing deal with artificial intelligence startup Groq, furthering its investments in companies connected to the AI boom.

- Global green bond and loan issuance has reached a record $947 billion so far this year, according to data compiled by Bloomberg Intelligence.

- Tesla Inc.’s door handles are facing renewed scrutiny in the US after federal auto safety regulators opened a probe into the emergency releases in certain Model 3 vehicles.

.jpg) 2 hours ago

4

2 hours ago

4

English (US)

English (US)