Article content

Despite Canadian retail sales rising 0.8 per cent in March from February, a Bank of Canada rate cut is back in play, says one Bay Street economist.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

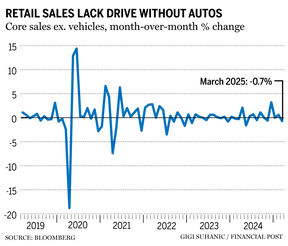

The increase in March was just shy of the estimate of 0.7 per cent, but was mostly due to a 4.8 per cent rise in auto sales, according to Statistics Canada data released on Friday.

Article content

The agency also estimated that retail sales for April will grow 0.5 per cent month over month.

Article content

Article content

“What was key was the woeful 0.7 per cent plunge in the ex-auto segment. That was the steepest slide since May of last year,” David Rosenberg, founder of Rosenberg Research & Associates Inc., said in a note.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

That segment, which excludes automobiles, was pulled down by a 6.5 per cent plunge in gasoline sales as prices and volumes fell.

Article content

Excluding vehicle sales — which economists said rose due to buyers trying to get ahead of retaliatory auto tariffs — and gas sales, retail sales were up 0.2 per cent month over month.

Article content

Article content

“All of a sudden, the Bank of Canada is back in play,” Rosenberg said, referring to policymakers’ next interest rate announcement on June 4.

Article content

Markets reduced their bets on a Bank of Canada rate cut earlier this week after core inflation came in hotter than expected. Headline inflation slowed in April mainly due to a drop in gasoline prices after the consumer carbon tax was eliminated, but the central bank’s preferred measures of core inflation accelerated.

Article content

Currently, markets predict there is less than a 30 per cent chance the central bank will cut rates next month.

Article content

Article content

But Rosenberg said the retail data, along with other measures that came out this week, shows that “the hot (consumer price index) number — which was mostly due to food price increases — was actually more lukewarm than it seemed on the surface.”

Article content

Article content

The other measures he is referring to include retail price deflation, which fell 0.1 per cent month over month, and “deflated” producer price data in April.

Article content

Plummeting business and consumer sentiment had set the stage for retail sales to come in weaker, according to the most recent Bank of Canada surveys.

Article content

Article content

But many still believe the better-than-expected showing in March and the strength of the April estimate are due to pre-spending ahead of tariffs taking their toll.

Article content

“The strength in retail sales is likely the result of consumers bringing forward some of their purchases ahead of potentially higher prices due to the trade tensions,” Charles St-Arnaud, chief economist at credit union Alberta Central, said in a note.

Article content

He said retail sales per person adjusted for inflation grew 0.3 per cent in March, while core sales were flat.

Article content

St-Arnaud also said retail sales per person were weaker in provinces such as Ontario and British Columbia, where consumer debt and insolvencies are higher.

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)