Full-blown trade war could throw country into recession

Published Jan 23, 2025 • 5 minute read

Article content

Article content

The Bank of Canada is heading into decision day next week with the country consumed by the threat of a trade battle with the United States.

Will it make a difference? Some economists think so.

Newly elected U.S. President Donald Trump has threatened to impose a 25-per-cent tariff on all goods from Canada. With that potential damage hanging over the economy, some think the central bank will once again cut interest rates, even though signs of growth and pressures on core inflation would justify a pause.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

“With the threat of tariffs looming large, we expect the governing council to opt for a 25-basis-point interest rate cut, said Thomas Ryan, North America economist for Capital Economics.

Trade trouble has escalated just as growth was getting back on track in Canada. Gross domestic product data for October and the early estimate for November point to fourth-quarter growth rising to 2 per cent, in line with the Bank of Canada’s forecast in the October monetary policy report, said Ryan.

Other encouraging signs were the 91,000 jobs the economy gained in December, blowing past expectations, and a moderate uptick in manufacturing sales.

Then there is the sticky point of inflation. Though the inflation rate slowed to 1.8 per cent in December this was mainly because of the federal government’s GST/HST holiday, which the Bank of Canada had already said it would “look through” when judging inflation trends.

If you took that tax break away, the inflation rate would be 2.3 per cent. Also measures of core inflation were a bit hot for comfort with the three-month annualized rate at 3.5 per cent, said Ryan.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

Article content

However, “the elephant in the room” when the Bank of Canada makes its decision Wednesday will be the new president south of the border who has repeatedly threatened to impose stiff tariffs on Canadian goods, he said.

“We believe that the heavy overhang of trade uncertainty — possible U.S. tariffs — overrides almost all else,” said Bank of Montreal chief economist Douglas Porter, in a note to clients Tuesday. “As a result, we suspect that today’s reading is just good enough to allow the Bank of Canada to trim next week, for risk management purposes.”

If Trump does impose the full 25-per-cent tariff on Canadian imports, Capital expects GDP would fall by about 3 per cent into recession.

Its base case, however, is that the U.S. President will limit the blow to a 10-per-cent universal tariff. That, along with a weaker Canadian dollar buffering the impact, should just slow growth rather than send it into contraction, said Ryan.

If that comes to pass, Capital expects two more quarter point cuts after the January meeting bringing the Bank of Canada’s rate to 2.5 per cent.

Others, however, think a pause on Wednesday would be more prudent. Derek Holt, Scotiabank’s vice-president and head of capital markets economics, said the Bank of Canada “should take a breather and hold next week.”

Advertisement 4

Article content

Holt says core inflation remains hot and U.S tariffs along with possible Canadian retaliation would add to these price pressures.

“Therefore, what’s the rush to cut after 175bps of cuts to date?,” he wrote in a note to clients. “I know one thing for sure: I wouldn’t cut at this point while leaving all options open going forward.”

Sign up here to get Posthaste delivered straight to your inbox.

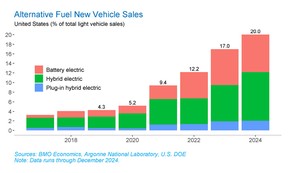

Electric vehicles had a banner year in the United States with sales of battery-electric vehicles and plug-in hybrid electric vehicles hitting a record high of nearly 1.57 million units or almost 10 per cent of the new vehicle market, BMO Capital Markets’ chart shows. Market share tops 20 per cent if you add in hybrid electric vehicles.

The road ahead, however, might not be as smooth, says BMO senior economist Erik Johnson.

An executive order by U.S. President Donald Trump Monday said his administration would terminate state emissions rules that limit the sale of gas-powered vehicles and would consider the elimination of “unfair” subsidies and “other ill-conceived government-imposed market distortions” that favour EVs over other vehicles.

Advertisement 5

Article content

The language in the order suggests Trump is likely to seek to repeal a $7,500 tax credit for new EV purchases approved by Congress, as well as roll back Environmental Protection Agency rules to tighten limits on greenhouse gas emissions and other pollution from vehicles, reports The Associated Press.

The new president has also promised to end a federal exemption that allows California to phase out the sale of gas-powered cars by 2035.

“We could be at the precipice of a slowing phase in the EV market (at least in the U.S.),” said Johnson.

- Today’s Data: Canada retail sales

- Earnings: Novagold Resources Inc., General Electric Co., Texas Instruments Inc, McCormick & Co Inc.

- Questions about Trump, tariffs and the 51st state. Read our Q&A for answers

- Could Ottawa’s investigation of Interac lead to lower transaction fees?

- Here are 5 Trump executive orders that could affect Canada

As the annual deadline for registered retirement savings plans approaches, now is a good time to evaluate how RRSPs and other financial strategies can work for you and your family.

Whether your goal is tax savings, income smoothing or building a financial legacy, RRSPs and tools such as spousal RRSPs and individual pension plans (IPPs) offer unique advantages. If you are a business owner, these tools are tailored to help you make the most of your income and secure your financial future.

Advertisement 6

Article content

Colleen O’Connell-Campbell, a wealth adviser at RBC Dominion Securities Inc., helps navigate some of the nuances of retirement and tax planning for owner-managed businesses. Find out more

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at [email protected].

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Recommended from Editorial

-

Who would Donald Trump's tariffs hurt the most?

-

Canada's own trade barriers amount to nearly 25% tariff

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)