Article content

(Bloomberg) — Prime Minister Narendra Modi’s government is likely to announce measures to improve the ease of doing business and boost infrastructure spending, while sticking to fiscal consolidation in the upcoming budget, as punitive US tariffs cloud the outlook.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

In the budget due Feb. 1 — among India’s most closely watched annual events — Finance Minister Nirmala Sitharaman is expected to push public spending as private investment remains muted amid lackluster earnings and foreign outflows. She is also expected to simplify import-duty regime and ease compliance for small businesses.

Article content

Article content

Article content

“The budget will focus on both resilience and growth,” said Dharmakirti Joshi, chief economist at Crisil Ltd. “The focus will be on maintaining fiscal discipline, giving the right signal for reforms and taking steps for private investments — partly through reforms and partly through incentives.”

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

India’s outlook is increasingly necessitating higher government spending, though any expansion is likely to be calibrated without undermining fiscal consolidation. Rising global risks are weighing on growth, with higher US tariffs threatening exports amid persistent geopolitical tensions. Domestically, uneven consumption and cautious private spending have sharpened the focus on policy support.

Article content

Capital spending —mainly on roads, ports and energy assets— in Sunday’s budget may cross 12 trillion rupees ($131 billion) for the next fiscal, surpassing 11.2 trillion rupees estimate in the current year, according to a median forecast of 29 analysts surveyed by Bloomberg News. Outlay for defense may rise after a military clash with Pakistan last year.

Article content

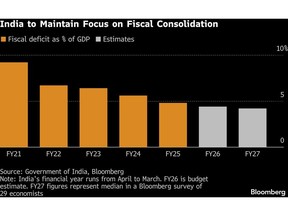

Analysts expect the finance minister to stick to the goal of reducing government debt with the fiscal deficit target seen lower at 4.2% of GDP for the next fiscal. The plan is to reduce federal debt to 50% of GDP, plus or minus one percentage point, by 2030-31.

Article content

Article content

The central bank cut the policy rate to more than a three-year low last month to support growth and offset the impact of 50% US tariffs on Indian shipments, partly linked to purchases of Russian oil. It also signaled scope for further easing if inflation remains soft, while injecting substantial liquidity to ease borrowing costs.

Article content

Uncertainty over a trade deal with Washington has also pressured the rupee, which tumbled nearly 5% last year. The economy grew a robust 8.2% in the July–September quarter but the outlook remains clouded by global factors. It is expected to expand 7.4% in the current financial year ending March 31.

Article content

Modi’s government is ramping up efforts to diversify India’s trade ties to reduce reliance on traditional partners such as the US and China. It agreed to a landmark free trade deal with the European Union that is seen as key to boosting exports and investment, while Canada is emerging as the next focus as New Delhi seeks new growth engines amid rising global protectionism.

Article content

Higher Dividend

Article content

To fund higher spending, Sitharaman is likely to rely more on dividends from the Reserve Bank of India and other financial institutions to bridge the deficit, with economists such as Pranjul Bhandari estimating payouts of as much as 3 trillion rupees this year. Economists see the government raising around 500 billion rupees through asset sales, indicating continuation of a lull in divestments.

Article content

Article content

While Modi’s popularity has remained resilient, there are growing expectations his government may use Sunday’s budget to court voters in key states such as Tamil Nadu and West Bengal. The ruling party plans an aggressive campaign in regions where it has traditionally remained a minor player.

Article content

“They tend to focus on the states where there are going to be elections, like they did Bihar last time,” said Shumita Deveshwar, chief economist at GlobalData.TS Lombard. “I wouldn’t be surprised if they did that again this time.”

Article content

—With assistance from Shinjini Datta and Swati Gupta.

Article content

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)