Article content

(Bloomberg) — Morgan Stanley’s Mike Wilson, not long ago one of Wall Street’s most steadfast bears, says he sees a bull market building in stocks. But first the S&P 500 Index may have to take a hit.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The bank’s chief US equity strategist sees US equity prices dropping 5% to 10% this quarter as the impact of President Donald Trump’s trade policies gets reflected on corporate balance sheets. He thinks the decline will be short lived, giving investors an attractive entry point to a rally that will ultimately be driven by improving expectations for corporate earnings growth.

Article content

Article content

Article content

“This is what the beginning of a new bull market looks like,” Wilson said Thursday in an interview on Bloomberg Surveillance. “It’s just explosive — it doesn’t let people in. The rate of change is accelerating beyond what you expected.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

He added that any pullbacks will be “short and shallow” and that he “absolutely” would buy those dips.

Article content

The S&P 500 is on track for another all-time high on Thursday amid a stunning recovery that has added roughly $11.5 trillion in value over just a few months. In early April, the index was on the cusp of a bear market after Trump unleashed sweeping tariffs on trading partners around the world. His decision to pause those levies a week later unleashed this latest wave of enthusiasm.

Article content

Wilson was one of a few Wall Street prognosticators to remain optimistic on US stocks throughout the volatility. Many of his peers quickly slashed their outlooks but had to subsequently change course as the market jumped back to new highs.

Article content

The S&P 500’s latest gains come as Corporate America and the US economy demonstrate resilience in the face of the White House’s ever-changing trade strategy. The enthusiasm also is being helped by the potential for profit growth from the recently passed tax bill.

Article content

Article content

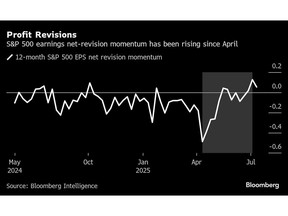

“The earnings revision breadth is explosive,” Wilson said. “You can’t deny the fact that companies are good at mitigating tariffs.”

Article content

The strategist sees the third quarter as “probably the quarter of risk,” as the impact of levies could start to flow through to the cost of goods sold. But he expects the market impact to be temporary, with investors quickly looking ahead to anticipated growth in 2026.

Article content

That prediction got support Thursday morning from a strong June US retail sales report, which tempered some concerns about consumer spending.

Article content

An early start to the earnings season offers a mixed picture around how companies are navigating Trump’s ever-changing trade plans. United Airlines Holdings Inc. on Thursday said the second half of the year has become more predictable, but suggested it may be able to beat its earnings targets after customers resumed booking flights. Meanwhile, Alcoa Corp., the largest US aluminum producer, said tariffs on imports from Canada cost it $115 million in the second quarter.

Article content

Still, Wilson expects the market to power ahead, despite the chances of a near-term drop due to the uncertainty surrounding the White House’s trade plans.

Article content

“We bottomed in April,” Wilson said. “All the indicators we look at from a rate-of-change standpoint have inflected sharply, and it’s even surprised us to the upside.”

Article content

—With assistance from Elena Popina, Jonathan Ferro, Annmarie Hordern, Lisa Abramowicz and Matt Turner.

Article content

.jpg) 15 hours ago

1

15 hours ago

1

English (US)

English (US)