Article content

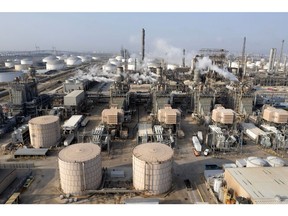

(Bloomberg) — Oil rose as the European Union agreed to a lower price cap for Russian crude, and data showed the US economy holding up despite the fallout from the Washington-led trade war.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Global benchmark Brent topped $70 a barrel, while West Texas Intermediate was above $68. EU member states agreed to the bloc’s 18th package of sanctions on Moscow over its war against Ukraine, including the lower cap, EU foreign affairs chief Kaja Kallas said in a social-media post. The limit will be set at $15 a barrel below market rates.

Article content

Article content

Article content

Since Russia’s invasion of Ukraine in 2022, the EU has agreed to repeated waves of sanctions including the cap, which is intended to reduce Moscow’s revenues from energy sales, while also seeking to keep those flows going into the global market to avoid a price spike. Earlier this week, US President Donald Trump’s also threated to impose tighter financial penalties on Russian energy, including nations taking its oil such as India and China.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Oil is higher so far this month, following gains in May and June. Both Morgan Stanley and Goldman Sachs Group Inc. have made the case in recent days that while global crude stockpiles have been expanding, the substantial builds have occurred in regions that don’t hold much sway in price-setting. The diesel market has also been tight, especially in Europe and the US.

Article content

“The logic of diesel tightness propping up crude flat prices remains unchanged,” said Huang Wanzhe, an analyst at Dadi Futures Co., who added that the peak-demand season had seen a solid start. “The key question is how long this strength can last,” she said.

Article content

In wider markets, strong US data eased concerns about the world’s largest economy, helping to underpin a risk-on mood and global equity rally. Asian stocks advanced.

Article content

Crude futures, as well as those for gasoil, remain in backwardation in the nearer months of their curves, which means traders are having to pay more to secure prompt supplies. That pattern points to tight conditions even as producers’ cartel OPEC+ has been relaxing output curbs at a rapid clip.

Article content

Advertisement 1

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)