Article content

Investors wondering about payoffs from the pile of cash being spent on artificial intelligence should get some clues when Microsoft Corp. and Meta Platforms Inc. post earnings after the close Wednesday.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

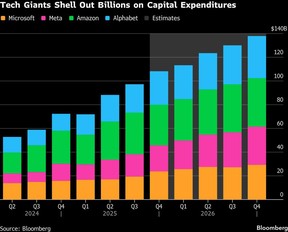

The tech giants are the first of Corporate America’s four biggest AI spenders to report, with results from Alphabet Inc. and Amazon.com Inc. due next week. This year alone, the quartet is expected to have about US$505 billion in combined capital expenditures, up from roughly US$366 billion estimated for 2025, according to data compiled by Bloomberg. As Wall Street grows increasingly concerned about the ability to generate profits from all this AI spending, the expenses are starting to be seen as potential risks for the high rollers.

Article content

Article content

Article content

The fear is starting to show up in the stock prices. Microsoft’s shares have slumped 11 per cent since the companies last reported earnings on Oct. 29, while Meta’s are down around 10 per cent. The S&P 500 is up 1.6 per cent over that span.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Every quarter investors are going to be looking to see what the ROI is on that spend,” said Jonathan Cofsky, a portfolio manager at Janus Henderson, which has about US$480 billion in assets and owns substantial positions in Microsoft and Meta.

Article content

Any hint that they plan to spend even more than anticipated on developing AI could weigh on the stocks, while simultaneously giving a boost to the companies benefiting from the largesse, like chipmakers Nvidia Corp., Broadcom Inc. and Micron Technology Inc.

Article content

So far, signs are pointing to the heavy spending continuing. Late Tuesday, Seagate Technology Holdings PLC said the outlook for demand for high-capacity hard drives from data centre owners looks strong through calendar 2027 and multiple cloud customers are discussing demand growth projections for 2028.

Article content

Seagate’s outlook sent the stock up as much as 18 per cent on Wednesday, and lifted peers including Western Digital Corp. and Sandisk Corp.

Article content

Article content

“The general investor expectation is whenever there’s a range it’s more toward the high end of the range, at least for 2026,” Cofsky said. “That bodes well for Nvidia, Broadcom, TSMC and the broader infrastructure trade.”

Article content

Article content

Article content

For Microsoft, all eyes will be on its Azure cloud-computing business, which is seeing brisk demand from companies developing and running AI services. In its fiscal first quarter, which ended in September, Microsoft said demand for Azure services “significantly” outpaced capacity. Revenue from the unit is projected to rise 38 per cent in the second quarter from a year ago, compared with 39 per cent in the first quarter.

Article content

Investors will also be on the lookout for signs of increased traction for Microsoft’s Copilot-branded products, its main vehicle for selling AI software tools to office workers. Details around how much those services are contributing to Microsoft’s sales growth have been sparse so far.

Article content

At the same time, shareholders are growing more anxious about software makers like Microsoft facing disruptions following Anthropic’s release of a new AI tool, Claude Cowork, to glowing reviews earlier this month.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)