Article content

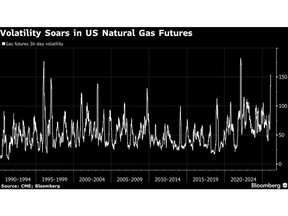

(Bloomberg) — The historic volatility witnessed in US natural gas futures over the past week caught out some money managers who use algorithmically driven trading strategies.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Gas futures doubled in a matter of days as Arctic weather gripped much of the country and sent demand for the fuel soaring. The turmoil inflicted losses on speculators who’d been betting prices would decline, including some market players known as Commodity Trading Advisers, or CTAs, according to analytics firm Kpler Ltd.

Article content

Article content

Article content

Volatility in US natural gas futures has surged to levels rarely seen in the 35-year history of the contract after the deep freeze boosted demand and strangled supplies. Although it’s too soon to assess the total dollar-value of CTA losses, it’s becoming clear the sudden rally wiped out all their gains for the year and that the scramble to close short positions as prices were skyrocketing actually accelerated the rally.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Some CTAs were holding 100% short positions in gas futures at the close of business on Friday, Jan. 16, according to Kpler. During the weekend, weather forecasts shifted dramatically to warn of a brewing, expansive winter storm that would sweep much of the nation.

Article content

When trading opened on Tuesday, Jan. 20 — the previous day was a US holiday — front-month futures soared as much as 29%. The advance continued over subsequent days as weather models sounded alarms, culminating in a record, six-session rally.

Article content

“With a market that was leaning short and giving up on winter, it was a perfect recipe for a dramatic move higher,” said Trevor Woods, chief investment officer of Northern Trace Capital. He switched his stance from short to long in time for the price surge.

Article content

Article content

Traders remain on edge because more frigid weather is on the horizon for much of US East.

Article content

One measure of gas-market volatility is at the highest since early February 2022, when winter weather lashed much of the nation, trapping some investors in a similar pincer movement of booming demand and stifled supplies. Prior to that, the futures market hadn’t endured this sort of violent fluctuation since 1996.

Article content

As demand for gas to fuel furnaces and power plants began to soar almost a week ago, frozen wells and pumping stations shut down 16% of domestic supplies.

Article content

Some CTAs managed to limit losses by closing out short positions and revert to long ones as the futures pushed through key price thresholds, according to Kpler.

Article content

Still, the total profits made by CTAs in the first few weeks of January were more than wiped out during the rush to close out shorts in the first two days of the rally, the research group said.

Article content

How It Unfolded

Article content

Going into the Jan. 17-19 holiday weekend, forecasts showed warmer-than-normal weather for the latter half of January. Hedge funds responded by piling into short positions, settling near the most bearish levels since 2024, according to data from the Commodity Futures Trading Commission.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)