Article content

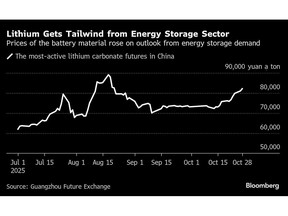

(Bloomberg) — Chinese lithium prices are getting a boost from growing confidence in demand for large-scale battery storage.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Energy storage systems, or ESS, are in vogue, thanks to policy tailwinds in China and stronger momentum worldwide for equipment that can stabilize electricity grids and support surging demand from the data centers that power artificial intelligence.

Article content

Article content

Article content

The most-active lithium carbonate contract on the Guangzhou Futures Exchange has risen for five sessions in a row. The spot market in China has rebounded to a two-month high, although prices are still about 85% below their peak in 2022.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Batteries are one of the new engines of China’s industrial growth strategy alongside solar and electric vehicles. Last month, the government unveiled measures aimed at scaling up ESS capacity and investment, including compensation mechanisms to ensure enough storage has been built to meet peak demand.

Article content

The plan is to more than double capacity to 180 gigawatts by 2027, which will help backstop rapidly increasing flows of, often intermittent, wind and solar power to the grid. That’s putting key ingredients for batteries, like lithium, in high demand, helping to alleviate concerns around egregious oversupply that first torpedoed prices at the end of 2022.

Article content

Global players are echoing the optimism. South Korea’s Samsung SDI Co. has been switching some EV battery lines to boost ESS production in the US. Australian miner PLS Ltd. said last week the sector is growing in “leaps and bounds.” According to BloombergNEF, energy storage additions around the world are on track to notch records in every year to 2035, cementing China and the US as the largest markets.

Article content

Article content

While demand for EV batteries will grow in the mid-20% range this year, the percentage expansion in ESS will be in the mid-50s, according to Chris Williams, analyst at consultancy Adamas Intelligence.

Article content

Market dynamics for lithium also favor higher prices. “We are entering a seasonally strong period on the demand side,” Williams said, adding that port inventories for the raw material have started to diminish.

Article content

The supply outlook in China is murky, after the government’s bid to control capacity left producers at the mercy of regulators. In the lithium hub of Yichun, the fate of a mine run by the world’s biggest EV battery maker, Contemporary Amperex Technology Co. Ltd., still hasn’t been decided, after the project was halted in August having failed to get its permit renewed.

Article content

On the Wire

Article content

A subtle change in language used by the Chinese government has left room for the world’s biggest coal user to prolong rising consumption through the end of the decade.

Article content

China pledged to “significantly” boost the share of consumption in its economy over the next five years while keeping tech and manufacturing as the top priorities, in an effort to become less reliant on exports after a steep escalation of trade tensions in 2025.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)