Article content

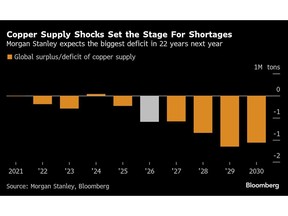

(Bloomberg) — Copper rose to a record high, with the US and China on the cusp of a sweeping deal to dial down trade tensions, while a series of supply setbacks at leading mines have tightened the global market.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Three-month futures climbed to $11,146 a ton on the London Metal Exchange, topping the peak set in 2024. Year-to-date, the metal that’s an industrial staple and proxy for global growth is up more than a quarter.

Article content

Article content

Article content

In Asia, US President Donald Trump is scheduled to meet with Chinese counterpart Xi Jinping at a bilateral summit on the sidelines of the APEC gathering in South Korea on Thursday. Ahead of that, Trump has talked up prospects for a deal between the world’s two largest economies.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

It’s been a tumultuous year for copper, one of the world’s most crucial commodities. Prices have been roiled by Trump’s trade war and sectoral sanctions, which drew vast quantities of metal into the US. There’s also been a spate of mishaps at major mines, including a mudslide at Freeport McMoRan Inc.’s vast Grasberg mine in Indonesia.

Article content

“Copper prices are being supported by a pick-up in risk appetite on optimism about a potential trade deal between the US and China,” said Craig Lang, a principal analyst at CRU Group. The metal has also been supported by the concerns about physical tightness in markets outside of the US, he said.

Article content

Copper futures rose 0.7% to $11,114 a ton on the LME as of 7:32 p.m. in London.

Article content

On the demand front, there’s widespread optimism about the need for greater volumes of copper to service the energy transition and the build-out of artificial intelligence data centers. In addition, China has pledged to “significantly” boost the share of consumption in its economy.

Article content

Article content

Earlier this week, Anglo American Plc warned that copper production from its most important mine would likely be lower than expected next year, adding to the already tight market. That follows disruptions at other mines from South America to Central Africa.

Article content

Stockpiles of copper held in LME-tracked warehouses — a vital window on the market’s global supply-and-demand balance — have been drawing in recent weeks. At present, inventories have dropped to the lowest level since July. Still, stockpiles tracked by Comex in the US remain elevated.

Article content

Copper — along with other commodities priced in the dollar — has also been aided this year by weakness in the US currency, which makes raw materials more attractive for overseas buyers. Later Wednesday, the Federal Reserve is expected to reduce interest rates again, which may hurt the greenback.

Article content

—With assistance from Katharine Gemmell.

Article content

.jpg) 11 hours ago

2

11 hours ago

2

English (US)

English (US)