Article content

(Bloomberg) — For much of the year, money managers have embraced optimism and snatched up corporate bonds, sending valuations to ever more expensive levels. Now, Wall Street titans are saying it’s time to focus on how bad things can get.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Jamie Dimon, chief executive officer of JPMorgan Chase & Co., and Josh Easterly, co-founder and co-chief investment officer of Sixth Street Partners, are among those warning that the credit market may not be pricing in enough risk. And the lowest rung of junk bonds are flashing warnings that the US economy could soon face slower growth and higher inflation, as well as the possibility of a recession.

Article content

Article content

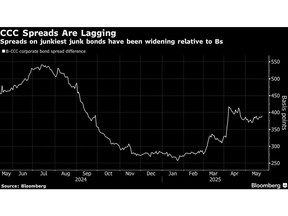

Risk premiums on junk bonds rated in the CCC tier have widened 1.56 percentage points this year, and 0.4 percentage point in the latest week. The gap between spreads on CCCs and the next tier above them, Bs, has been widening this year and in the last two weeks, signaling that the weakest bonds are lagging.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The CCC widening and underperformance are red flags, said Connor Fitzgerald, fixed-income portfolio manager at Wellington Management, a firm that oversees more than $1 trillion of assets.

Article content

“I wouldn’t recommend somebody make a big move into high yield today, because spreads are tight and if you think there’s concern about a recession, you risk default-related losses,” Fitzgerald said in an interview.

Article content

Dimon, who was early to spot risks in the mortgage market during the US housing bubble, said on Monday that credit spreads aren’t accounting for the impacts of a potential downturn. He added that the chances of elevated inflation and stagflation are greater than people think and cautioned that America’s asset prices remain high.

Article content

Credit is a “bad risk,” Dimon said at JPMorgan’s investor day. “The people who haven’t been through a major downturn are missing the point about what can happen in credit.”

Article content

Article content

Yet investors are still buying at least some junk bonds. CoreWeave Inc., an AI cloud hosting firm, sold $2 billion of five-year notes on Wednesday, finding enough demand to boost the size of the offering from $1.5 billion. And in the US investment-grade market, companies sold more than $35 billion of bonds this week, topping dealers’ forecasts of around $25 billion.

Article content

Corporate debt has rallied since the violent swings of April, partly because investors have had cash from maturing securities to reinvest into the credit market, said Blair Shwedo, head of fixed income sales and trading at U.S. Bank. But geopolitical tensions and tariff uncertainty could hurt demand for company debt and cause spreads to widen.

Article content

Market sentiment can shift quickly. In April, days after US President Donald Trump announced the steepest tariffs for the country in a century, spreads climbed to their widest since March 2020. Soon after that, they tightened again.

Article content

There are many risks ahead. US President Donald Trump on Friday threatened a 50% tariff on goods from the European Union starting next month, signaling trade wars are far from settled. The Federal Reserve’s interest-rate path is also unclear, as is when, or if, economic data will start to show signs of deteriorating.

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)