Article content

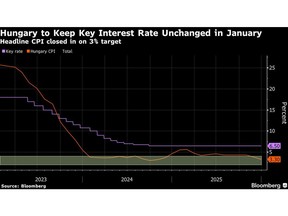

(Bloomberg) — Hungary will probably keep its key interest rate unchanged as policymakers looking to start monetary easing seek evidence that slowing inflation can be sustained.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The National Bank of Hungary will keep its benchmark interest rate at 6.5% on Tuesday for a 16th month, tied with Romania for the highest level in the European Union, according all but one of 23 economists in a Bloomberg survey. One forecasts a quarter-point cut. The decision is scheduled for 2 p.m. in Budapest, followed by a briefing and statement an hour later.

Article content

Article content

Article content

Article content

The central bank changed its monetary-policy guidance last month from ruling out rate cuts to making decisions “meeting by meeting” based on incoming economic data. The bank said its projection showed inflation within the 1 percentage point tolerance band around its 3% target over the monetary horizon.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

While inflation slowed further in December, closing in on the central bank’s target, Deputy Governor Zoltan Kurali on Jan. 14 pointed to “stubborn” services inflation, a key gauge for inflation expectations, which at 6.8% was more than double the headline data last month. Policymakers need “a lot of conviction” before beginning rate cuts, Kurali said.

Article content

That’s likely to shift the focus to February, following the publication of key January inflation data that may show the extent of repricing at the start of the year, especially in the services sector. The statistics office will publish the data on Feb. 12.

Article content

Money market traders expect one or two quarter-point rate cuts in the next three months, possibly with the first one as soon as in February, according to forward rate agreements. Hungary holds parliamentary elections on April 12, with Prime Minister Viktor Orban’s party trailing in most polls after 16 years in power.

Article content

The forint’s appreciation — it’s close to a two-year high against the euro amid an emerging-market rally and dollar weakness — is widening the room for rate cuts by limiting the cost of imported goods, including energy.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)