Article content

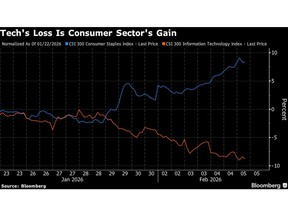

(Bloomberg) — Chinese consumer stocks are winning favor with investors just as their high-flying tech peers lose ground amid a global rout, with expectations growing that the former will benefit from increased spending during the upcoming Lunar New Year break.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A gauge of consumer staples rose for a fourth straight session and was the top performer among sector groups on China’s CSI 300 Index on Thursday. It jumped as much as 1.7% — with shares of heavyweight liquor maker Kweichow Moutai Co. among the biggest gainers. In comparison, the CSI benchmark was down 1% and a measure of tech shares headed for its third decline this week.

Article content

Article content

Article content

Investors are attributing at least a part of the consumer sector’s rally to a rotation away from tech stocks, which have plunged this week as part of a wider selloff driven by concern over valuations and the disruption caused by artificial intelligence. Meanwhile, shares of firms in the discretionary sector too are rising on bets that the likes of cosmetics retailers, restaurant and hotel operators and airlines may see demand surge during the mid-February break.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Increased uncertainty around the AI monetization narrative and a perceived rise in regulatory risk across digital sectors appear to have prompted some capital to rotate into high‑quality consumer franchises with more visible earnings profiles and relative insulation from policy risk,” said Gary Tan, a portfolio manager at Allspring Global Investments.

Article content

It’s early to say if this rotation will sustain given that the moves have only started this week, he added.

Article content

The consumer staples and discretionary sectors were among the biggest underperformers amid last year’s broad rally in Chinese stocks, owing to weak demand in an economy weighed down by deflationary pressures, a housing slump as well as trade concerns. That prompted Beijing to announce initial public spending plans worth a total of $51 billion to boost consumption and investment in 2026.

Article content

Article content

The CSI 300 Consumer Staples Index is up almost 5% so far this year after sliding more than 8% in 2025 in what was a fifth straight annual decline.

Article content

While overall growth in consumption remains slow, “there are pockets of growth and some of these pockets could be really exciting,” said Herald van der Linde, head of Asia Pacific equity strategy at HSBC Holdings Plc.

Article content

Foshan Haitian Flavouring & Food Co., which manufactures food seasonings, saw its shares jump nearly 5% on Thursday to be the top gainers on the staples gauge. Next in line was energy-drink maker Eastroc Beverage Group Co., whose stock climbed more than 3%.

Article content

Shares of Chinese consumer firms listed in Hong Kong also rallied. Yum China Holdings Inc.’s stock surged more than 9% after the restaurant operator reported better-than-expected operating profit in the fourth quarter, defying a price war in the food delivery market.

Article content

—With assistance from Charlotte Yang.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)