Article content

(Bloomberg) — The European Central Bank is set to hold interest rates steady for a fifth meeting, judging that the latest bout of global tensions and euro strength haven’t thrown the economy off course yet.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

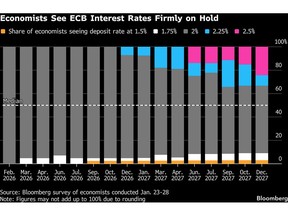

The deposit rate will be kept at 2% on Thursday, according to all respondents in a Bloomberg survey. Analysts and markets see them staying there through the end of next year, with the chances of a hike in 2026 receding.

Article content

Article content

Article content

Policymakers are digesting an eventful start to 2026 that’s included the strongest attacks to date on the Federal Reserve, the ouster of Venezuela’s president and threats by Donald Trump of more tariffs — this time over Greenland.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The upshot has been a weaker dollar that briefly propelled the euro to its highest level since 2021. That could spell trouble for exporters just as the economy looks like finding its feet. There’s also a risk it will pull inflation further below the 2% target, though the danger is being offset by a rise in oil and gas prices.

Article content

Without fresh projections to help navigate the tricky waters, President Christine Lagarde will probably keep her options open when she speaks to reporters at 2:45 p.m. in Frankfurt, 30 minutes after the decision is published.

Article content

“The ECB probably won’t take a strong view on the exchange rate or the rise in energy costs, as the challenge to the forecasts is still limited,” Bank of America economist Evelyn Herrmann said. “They’re likely to put relatively more emphasis on the renewed rise in uncertainty since the start of the year.”

Article content

Article content

- Follow the ECB TLIV blog here

Article content

Interest Rates

Article content

The ECB is showing little appetite to move borrowing costs in either direction, with Chief Economist Philip Lane saying the latest forecasts imply there’s no “near-term interest-rate debate.” Germany’s Joachim Nagel agrees, while Executive Board member Piero Cipollone reckons the ECB is “undoubtedly in a good place” — despite uncertainty.

Article content

What Bloomberg Economics Says…

Article content

“Europe has had a geopolitically turbulent start to the year, and the ECB will likely continue to focus on the forest instead of the trees. That means it will probably shrug off the recent US trade dispute linked to Greenland, the slight dip of inflation below its 2% target and the appreciation of the euro.”

Article content

—David Powell and Simona Delle Chiaie. Click here for full PREVIEW.

Article content

Officials are aware of how rapidly things can change, however. Austria’s Martin Kocher emphasized in a Bloomberg Television interview the need for “full optionality,” saying policy must be able to react to risks “quickly and decisively.”

Article content

While investors also expect no movement on rates, they see a bigger chance of another cut this year, while pricing greater odds of a hike further out.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)