Article content

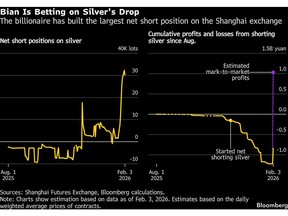

(Bloomberg) — A billionaire Chinese trader who made his name riding gold’s record-breaking rally has turned his sights to silver’s breakneck surge, with a bet on the metal’s collapse now worth almost $300 million.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Bian Ximing, who avoids the limelight and spends much of his time in Gibraltar, has made nearly $3 billion from bullish bets on Shanghai Futures Exchange gold contracts since early 2022. He has now built the bourse’s largest net short position in silver, according to Bloomberg analysis of exchange data and people with knowledge of his investments. They asked not to be named as the information is not public.

Article content

Article content

Article content

Bian’s big short comes with significant risk, and he has been forced to liquidate some positions at a loss in a volatile silver market. But he now holds a short that stands at about 450 tons of silver, or 30,000 contracts — so the metal’s sharp drop since last week has resulted in a paper gain of about 2 billion yuan ($288 million).

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Including previous losses, Bian stands to make a net profit of around 1 billion yuan, based on his position and prices at the end of Tuesday. Silver is again sliding in Thursday trade and has tumbled more than 16% — almost certainly significantly increasing Bian’s proceeds.

Article content

Bian, through his brokerage Zhongcai Futures Co., began ramping up silver shorts in the final week of January, according to exchange data. SHFE does not detail the identity of individual investors behind brokerage accounts, but the people said Bian’s own bets — and products he directly manages for a small number of clients — make up the bulk of the company’s precious metals positions.

Article content

Bian and Zhongcai Futures did not respond to emails seeking comment.

Article content

Exchange data showed Zhongcai’s silver short position surged to about 18,000 lots on Jan. 28. It climbed further to about 28,000 lots on Jan. 30, when the metal in Shanghai reached an all-time high.

Article content

Article content

China’s Big Short

Article content

Bian’s bet comes as weeks of dramatic price swings are beginning to prompt market watchers to rethink their single approach to precious metals. While many institutional investors continue to view gold as a hedge against interest-rate shifts, central-bank buying and global uncertainty, silver’s surge is increasingly seen as an industrial rally pushed higher largely by speculative positioning — not economic and other fundamental factors.

Article content

Bian gained notoriety in China’s futures markets for aggressively bullish bets on gold that began nearly four years ago. He is one of a handful of larger-than-life characters that have dominated commodities trading since the economic boom began more than two decades ago. Unlike many of his peers, he has stood out for his seclusion — and for the loyal following his musings on investment philosophy have garnered online.

Article content

From August last year, he built a long position in silver that generated more than 1.3 billion yuan in profit, according to calculations based on exchange data.

Article content

In November, however, he began shifting his position, attempting to call the top of the rally with tentative moves that occasionally left him on the losing side of trades. From last week, however, Bian held his short position with conviction, spreading his exposure across longer-dated contracts and holding it through upward price swings.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)