Article content

(Bloomberg) — A relentless selloff in BYD Co. shares is laying bare investor anxiety over the profit outlook for China’s electric-vehicle sector, as cooling demand at home and surging raw material costs trigger a brutal reset of expectations.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

BYD’s Hong Kong-listed shares have dropped about 7% this week after disappointing sales data, extending a selloff that has shaved off more than $60 billion in market value since May. The slump reverberated across EV peers, compounding woes for a stock market also grappling with fresh concerns over taxes and business disruption from artificial intelligence.

Article content

Article content

Article content

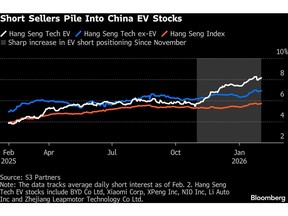

Traders had already braced for weaker EV growth this year on lower government subsidies, reflected in a build-up of bearish bets since November. Still, the pace of demand deterioration has caught many off guard. Adding to the strain, soaring costs for battery materials and memory chips are likely to squeeze automakers’ margins even further.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Investor sentiment is extremely negative,” said Xiao Feng, co-head of China industrial research at CLSA in Hong Kong. “The deeper worry is that we’ll see large-scale earnings downgrades this year, raising doubts about the EV makers’ long-term ability to generate profits in China’s domestic market.”

Article content

Exports remain a bright spot, but Chinese car manufacturers still rely heavily on the fiercely competitive domestic market, where consumers remain skittish. Morgan Stanley notes that most local automakers expect first-quarter volumes to drop 30–40% from the December quarter.

Article content

January sales underscored that even market leaders aren’t immune. BYD’s domestic deliveries for the month halved versus a year ago to 109,569 units, while last year’s outperformer XPeng Inc. reported more than a more than 30% decline in total deliveries.

Article content

Article content

More troubling for investors is the profit impact of surging raw material costs while EV makers are still burning cash on promotions to lure buyers. The price of lithium for EV batteries has more than doubled over the past three months, while copper and aluminum have also surged. The supply crunch in memory chips is making intelligent auto components more expensive.

Article content

“Cost inflation is the main risk,” said Joanne Cheng, investment manager for China equities at Aberdeen Investments. “Whether auto OEMs can pass through to retail customers while competition remains fierce is a question.”

Article content

Market estimates show additional cost per vehicle could reach about $1,000 or more for some premium models. Bernstein research indicates mass-market brands with weaker margins like Xpeng, Li Auto Inc. and Nio Inc. are more vulnerable, while BYD is better positioned thanks to its in-house parts supply.

Article content

There are some positive developments for the industry. Signs of improving trade ties with Canada and the European Union augur well for continued export momentum. Automakers are also venturing into such emerging tech areas as AI, humanoids and robotaxis that could help drive share prices.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)