Article content

(Bloomberg) — France’s progress this year in reining in its budget deficit has failed to impress some bond investors, who say the risk of fiscal deterioration has just been pushed down the road.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

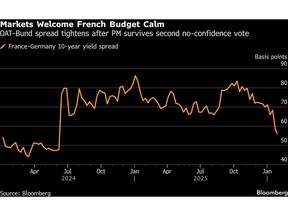

French bonds have rallied as Prime Minister Sebastien Lecornu survived no-confidence votes from opposition parties unhappy with his taxing and spending plan. The budget, which aims to bring the deficit down to 5% of gross domestic product, is on a path to approval.

Article content

Article content

Article content

The yield premium of the country’s 10-year debt over safer German peers has narrowed to the lowest since June 2024, when President Emmanuel Macron kicked off 18 months of instability by calling a snap election.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Yet France is far from meeting the European Union requirement that it bring the deficit down to 3% of GDP by 2029. That means further effort next year, when voters choose a new president and possibly a new Parliament — hardly a time when politicians will be inclined to pass painful budget measures.

Article content

For investors such as Mediolanum International Funds Ltd. and Ninety-one Asset Management, that’s a reason they’re paring their holdings of French debt.

Article content

“Although recent developments have delivered some short‑term relief for French spreads, the broader political and fiscal outlook is still troubling,” said John Taylor, head of European fixed income at AllianceBernstein, who has held an underweight position in French bonds.

Article content

Investors took fright in 2024 when France reported a much wider-than-anticipated deficit after years of spending on the Covid and energy crises. After the snap election that year, Parliament was roughly evenly divided among three political blocs, leaving lawmakers unable to agree on a budget and leading to the collapse of successive governments.

Article content

Article content

The premium investors demand to hold French debt over German bunds soared to almost 90 basis points by the end of 2024.

Article content

Even after this year’s rally, the yield on French 10-year OATs, at 3.43%, is still higher than similar bonds from Spain and Portugal, and about the same as those on debt from Italy and Greece — a sign that investors now view France in the same light as peripheral euro-area bond issuers.

Article content

Through all the drama, economic growth has held up. The country’s output probably expanded by 0.8% last year, according to economists’ forecasts, and will accelerate to 1% this year and 1.1% in 2027. And following the no-confidence votes, markets now have a relative period of political calm until the presidential election in Spring 2027.

Article content

But even if France achieves its deficit target this year, the budget relies largely on temporary tax increases to do so and does little to tackle persistently high spending on social security. Significant efforts will still be needed if France is to meet its pledge to investors and the EU to return the gap to 3% of economic output by 2029.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)