Article content

(Bloomberg) — Australian unemployment declined in October and the economy added more jobs than anticipated, suggesting the labor market remains tight and vindicating the Reserve Bank’s decision to leave interest rates unchanged.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The jobless rate fell to 4.3% from 4.5% in September and was better than the predicted 4.4%, data from the Australian Bureau of Statistics showed Thursday. Employment advanced by 42,200 — led entirely by full-time roles — more than double the expected 20,000 gain.

Article content

Article content

Article content

The Australian dollar and policy-sensitive three-year government bond yields jumped after the data, erasing an earlier decline, as traders slashed expectations for rate cuts next year. Money markets are pricing about a one-in-three chance of an easing by June, down from three-in-four prior to the data. Stocks extended losses.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“With the RBA already suggesting that the labor market errs tight, the output gap is positive and there is stickiness in inflation, these data will largely reinforce that view and keep them on the sidelines for the foreseeable future,” said Su-Lin Ong, chief economist at Royal Bank of Canada’s Australian unit.

Article content

“Labor market resilience amid an economy with little spare capacity suggests that a slightly restrictive policy stance at 3.6% is both appropriate and prudent.”

Article content

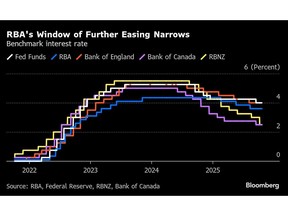

Jobs data are crucial for the RBA’s rate-setting board as the resilience of the labor market, and worries about its tightness potentially rekindling price pressures, have been among factors driving a cautious approach in the current easing cycle. The central bank kept borrowing costs unchanged last week and Governor Michele Bullock signaled further easing is unlikely in the near-term after three rate cuts this year.

Article content

Article content

The RBA expects the jobless rate will sit at 4.4% through its forecast horizon while employment growth is seen slowing this year and next. The forecasts released last week assumed the cash rate at 3.4% in mid-2026, implying just one cut between now and June.

Article content

Australia’s labor market has been a bright spot in the economy, though it has gradually cooled from post-pandemic highs. Even so, the RBA’s latest assessment was that the jobs market remains tight based on a range of indicators including an elevated ratio of vacancies to employed workers, above-average share of firms experiencing difficulty finding workers, high unit labor cost growth and model estimates of full employment.

Article content

Data released this week have pointed to a strengthening in the economy, with optimists taking the ascendancy in monthly consumer confidence for the first time in nearly four years and home loans surging to a record in the third quarter led by lending to investors.

Article content

In a sign of a pick up in economic momentum, data from Colliers shows retail rents in Sydney CBD have risen 3% since 2022, driven by strong tourism, infrastructure upgrades and a surge in luxury and dining demand while vacancy rates have dropped with foot traffic now at 84% of pre-pandemic levels.

.jpg) 1 hour ago

1

1 hour ago

1

English (US)

English (US)