Article content

(Bloomberg) — Oil extended its drop after slumping the most since June as OPEC said crude supplies surpassed demand sooner than anticipated.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Global benchmark Brent fell toward $62 a barrel after losing almost 4% in the previous session, while West Texas Intermediate was near $58. Energy stocks in Australia declined. Global shares held a three-day gain that took them to within touching distance of a record high as the US House passed a bill to end the longest-ever government shutdown. The S&P 500 Index has risen for four successive days as optimism built over a resolution to the shutdown.

Article content

Article content

Article content

A gauge of Asian shares was flat, with Japanese indexes advancing amid a weaker yen. The currency has been the focus of investors after the country’s Finance Minister Satsuki Katayama issued a fresh warning on currency movements. The yen hovered around the key threshold of 155 per dollar, inching closer to levels where authorities last intervened in markets.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

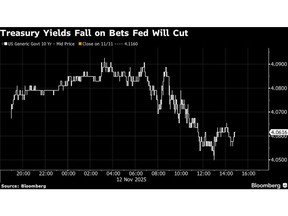

With US earnings season nearing completion, markets are shifting focus to the Federal Reserve and the outlook for potential interest-rate cuts. The absence of key indicators — such as unemployment figures and October’s consumer price index — has fueled uncertainty around monetary policy, with the White House confirming those reports are unlikely to be released due to the shutdown.

Article content

“While the markets are pricing the end of the government shutdown, there is an even bigger mountain ahead of us, and that is the resumption of all of the economic data that we have missed,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “As the fog lifts, we will see if market positioning has been correct and it is still clear sailing or if there is a big repricing necessary.”

Article content

Article content

A six-week clash between President Donald Trump and congressional Democrats that disrupted flights across the country and delayed food aid for millions is set to end within hours after the House passed a temporary funding bill.

Article content

The House voted 222 to 209 Wednesday evening to pass the interim funding, although fully restarting the federal bureaucracy after the longest US government shutdown in history could still take days.

Article content

Trump is expected to sign the bill Wednesday night in Washington to help reopen the government.

Article content

With the government shutdown delaying key economic data, the real challenge isn’t the short-term drag on growth — it’s the increasing difficulty for investors and the Fed to gauge the economic outlook, noted Seema Shah at Principal Asset Management.

Article content

“As data releases resume, the case for a Fed rate cut in December should re-emerge, reinforcing a risk-on backdrop,” she said. “This environment favors US equities, particularly Big Tech and cyclicals poised to benefit from a more accommodative Fed stance.”

Article content

Still, Boston Fed President Susan Collins said she favored holding rates steady amid still-strong growth that could slow or stall progress on cooling inflation.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)