Article content

Silver’s exceptional volatility in recent days has captured the zeitgeist — with even the likes of Elon Musk drawing attention to the metal’s ferocious rally to all-time highs.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The metal rose to a record above US$84 an ounce early Monday, before promptly crashing close to US$70 in thin, post-holiday trading. It was one of silver’s largest price reversals ever.

Article content

Article content

Article content

Prices remain up more than 150 per cent this year. Now the big question is: where does silver go from here?

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Here are key charts to watch in the silver market to evaluate what happens next.

Article content

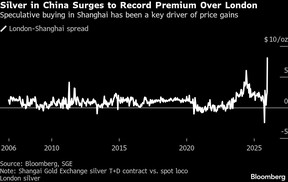

Chinese buying

Article content

Surging investor interest in China has been a key driver of silver prices in recent days. Speculators piled into the precious metal, mirroring a similar dynamic playing out in platinum. Elevated buying in the Shanghai Gold Exchange’s silver contract in December has pushed premiums to a record high, dragging other international benchmarks along.

Article content

Article content

The blistering rally provoked the country’s only pure-play silver fund to turn away new customers last week, after repeated risk warnings went unheeded. The fund’s manager announced the unusual step Friday after multiple actions — from tighter trading rules to cautionary advice about “unsustainable” gains — failed to quell an eruption of interest fuelled by social media.

Article content

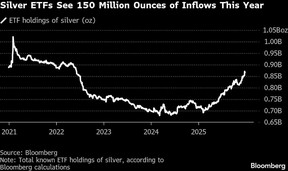

ETF inflows

Article content

Holdings in physical-backed silver exchange-traded funds have surged this year, rising by more than 150 million ounces. The total amount of metal held by the funds is still below a peak set during a Reddit-driven retail investment surge in 2021, but the inflows have been instrumental in eroding available supplies in an already tight market. Holdings in the funds have risen every month but one this year, according to Bloomberg calculations.

Article content

Article content

Article content

Article content

Technical indicators, margins

Article content

Silver prices jumped more than 25 per cent in December alone, on track for the biggest monthly increase since 2020. The speed of the gains meant some technical indicators were signalling that prices had run too far, too quickly. The metal’s relative strength index — a gauge of buying and selling momentum — has stayed above 70 for most of the past few weeks. A reading higher than 70 usually indicates that too many investors bought silver in a short period.

Article content

Article content

Some exchanges are moving to rein in risk amid heightened volatility. The margins for some Comex silver futures contracts will be raised from Monday, according to a statement from CME Group Inc. That’s adding to headwinds since traders will need to put up more cash to keep their positions open. Some speculators won’t want to do that and will be forced to shrink or close their trades instead.

Article content

Options frenzy

Article content

One indication of speculative fervour has been the level of buying for call options, both on silver futures and related ETFs. Call options, which give the buyer the ability to buy a security at a pre-determined price level, are typically seen as a cheap way to bet on market upside.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)