Article content

(Bloomberg) — South Korea’s $206.5 billion sovereign wealth fund is standing by US Treasuries as a core holding, undeterred by recent market volatility.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

“We are happy to invest in US Treasuries in a sense that the bonds give very strong liquidity and stable returns,” regardless of short-term market volatility, Park Il Young, chief executive officer of Korea Investment Corp., said in an interview with Bloomberg.

Article content

Article content

Article content

Park’s remarks underscore the enduring appeal of US assets for long-term investors such as sovereign wealth funds, even after recent bouts of volatility have undermined their allure. Uncertainties over President Donald Trump’s trade policy and ballooning fiscal deficits have roiled the Treasury market and pushed a gauge of the dollar down more than 10% from a January high.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Investors have been diversifying exposure as a long-term trend, and it’s unlikely that the Trump administration’s policies will shake the dollar’s status as a key reserve currency, he said.

Article content

“As for the weight of UST in our portfolio, we don’t have any plans to change it yet. We don’t have any specific plans. Basically, the nature of bond investment is to secure stability and liquidity,” Park added. The fund does not give out details of its Treasuries holdings.

Article content

Despite the turmoil in financial markets, foreign investors’ holdings of US Treasuries held close to a record high in April, latest data showed. Japan and Britain raised their holdings, while China and Canada cut their exposure, the data showed.

Article content

Article content

Read: Foreign Treasuries Holdings Held Near a Record in April Turmoil

Article content

While Park acknowledged potential risks to fixed-income investments stemming from inflation and shifts in US fiscal and interest-rate policy, he also expected continued efforts to stabilize interest rates.

Article content

America’s rising debt and deficit, a downgrade by Moody’s Ratings and Trump’s massive budget bill are further clouding the outlook of the world’s biggest economy.

Article content

That puts investors from Asia, including institutions like KIC, at the center of efforts to finance America’s deficits, particularly through sustained demand for Treasuries, a critical pillar of US economic stability.

Article content

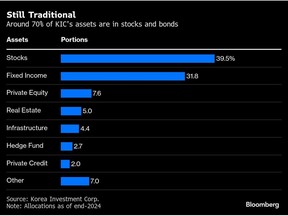

KIC held nearly 64% of its public assets in North America as of end-2024, up from from 61.1% in 2023. The sovereign fund, which returned 8.49% last year, only invests in overseas assets.

Article content

Article content

Alternative Assets

Article content

Park, who took the helm in September, is under pressure to improve the fund’s performance. During a parliamentary audit last year, lawmakers criticized KIC for lagging behind its peers. Norway’s sovereign wealth fund, Norges Bank Investment Management, posted a 13% return last year.

.jpg) 7 hours ago

2

7 hours ago

2

English (US)

English (US)