Article content

(Bloomberg) — UK consumers are turning cautious as a summer of sun, sport and shopping gives way to an autumn dominated by fiscal fears ahead of Chancellor of the Exchequer Rachel Reeves’ budget.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Retail sales grew more than forecast in August when warm weather helped boost clothing and bakery sales, the Office for National Statistics said on Friday. Shopping volumes rose every month this summer as promotions and big sporting events like the Wimbledon tennis tournament and the Euro 2025 women’s soccer championship encouraged spending.

Article content

Article content

Article content

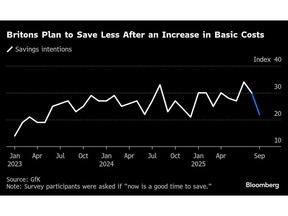

However, there are signs that the mood is starting to sour. Households are struggling to save as more of their income is eaten up by the rapidly rising cost of food and other essentials, according to a GfK survey.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

GfK’s index tracking savings intentions plunged eight points in September, the biggest decline in a year. Overall consumer confidence slipped two points to minus 19 as Britons became more downbeat about their personal finances and the state of the economy, and less willing to splash out.

Article content

Deteriorating sentiment brings more bad news for Chancellor of the Exchequer Rachel Reeves, whose hopes of revving up the slow-growing British economy depend heavily on the financial well-being of consumers.

Article content

Reeves is expected to raise taxes again in the Nov. 26 budget to repair a new multibillion-pound hole in the public finances. Those fears intensified after separate figures Friday showed government borrowing came in significantly higher than forecast in August. The pound and gilts fell.

Article content

August’s 0.5% increase in retail sales were an outlier in the latest batch of economic data released this week, which painted a darkening picture for households. Inflation remained at its highest level since early 2024, while jobs are declining and wage growth is cooling.

Article content

Article content

Consumers will “have to contend with the prospect of weaker real household income growth, as inflation rises and pay growth slows, fiscal policy tightens further, and the lagged impact of past interest-rate rises on some mortgagors continues to emerge,” Matt Swannell, chief economic advisor to the EY ITEM Club, said.

Article content

The GfK survey chimes in with a report from the British Retail Consortium revealed mounting pessimism among households, whose spending drives around 60% of gross domestic product. After a period of strong wage growth, family budgets are being squeezed again by a resurgence in food and energy bills.

Article content

Food makers predict that grocery inflation will hit 6% by the end of the year, blaming the increase on the big rises to payroll taxes and the minimum wage that hit employers in April.

Article content

The Bank of England is unlikely to provide more relief to households in the next months. Policymakers voted to keep interest rates on hold on Thursday as they’re more worried about sticky inflation than slow growth, and markets see no prospect of another cut this year.

Article content

GfK found consumers are becoming more reluctant to spend on big-ticket items like furniture or electronics. An August interest-rate cut was eclipsed by concerns over rising prices for everyday items, according to GfK’s Consumer Insights Director Neil Bellamy.

Article content

“With tax rises expected in the November budget, the risk is that confidence inevitably falls,” Bellamy said.

Article content

—With assistance from Philip Aldrick.

Article content

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)