Article content

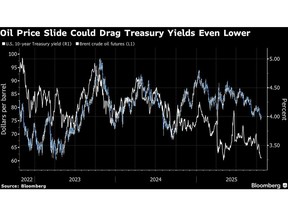

(Bloomberg) — Falling oil prices may drive benchmark Treasury yields back to levels last seen more than a year ago, according to Wall Street research veteran Ed Yardeni.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Yields on 10-year Treasuries could hit 3.75% if the oil price continues to slide and the Federal Reserve lowers interest rates next week, said the strategist. His argument is based on the long-run correlation of the two asset classes, which are linked through oil’s impact on inflation.

Article content

Article content

Article content

“A growing glut of oil and fear of a global economic slowdown have pushed US West Texas Intermediate crude prices to their lowest point since fuel markets were rebounding from the Covid crash,” Yardeni Research Inc. wrote in a note on Oct. 20. “That will help push headline consumer inflation rates down and boost consumers’ purchasing power.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The move would add yet more steam to a recent rally in Treasuries, which have been buoyed by bets on interest rate cuts and jitters around regional banks in the US. The 10-year yield was at around 3.98% during Asian trading hours on Tuesday, cementing a roughly 17 basis points decline this month.

Article content

Crude oil futures have dropped from as high as $80 a barrel in January to below $58 on Tuesday, and 10-year yields have also tumbled this year. But the bond rally is coming at an unusual moment in markets: Treasuries are gaining at the same time as stocks, marking a rare alignment as traders bet the economy can slow just enough to tame prices without sliding into recession.

Article content

Oil’s slide could bolster Treasuries given lower energy costs are likely to further cool inflation and strengthen the case for more Federal Reserve interest rate cuts, potentially giving current “Goldilocks” markets more room to run.

Article content

Advertisement 1

.jpg) 9 hours ago

3

9 hours ago

3

English (US)

English (US)