Article content

Silver and gold drop on Trump’s Fed pick, Raymond James update their Canadian energy company picks and more from The Week in Stocks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stock of the week: Meta Platforms Inc.

Article content

Article content

Meta Platforms Inc. (META:Nasdaq) found favour with investors this week after it reported a jump in ad revenue and issued a strong forecast for the next period that went some way to convincing investors that the company’s mega-investments and capital expenditures in artificial intelligence are paying off. Shares of Meta jumped 10 per cent following the release of earnings on Jan. 29 and were up about seven per cent on the week though they relinquished some of those gains on Friday. Meta fell out of favour late last year as investors questioned the company’s AI spending spree, estimated at US$72 billion for 2025. From October to late November, shares of Meta fell nearly 22 per cent. BMO Capital Markets analyst Brian Pitz hiked his price target for Meta to US$730 from US$710 noting a “strong” fourth quarter result as revenue and operating income beat consensus by 2.5 per cent and 2.9 per cent, respectively. For the first quarter of 2026, Meta said it expects revenue to come in seven per cent above consensus. “Importantly, META is seeing green shoots from its massive AI investments (US$132 billion in 2026 capital expenditure), which are improving its recommendation models, leading to increased user engagement and monetization,” Pitz said. The 12-month price target for Mega based on 67 analysts is US$852.16, according to Bloomberg. Meta closed at US$716.50.

Article content

Article content

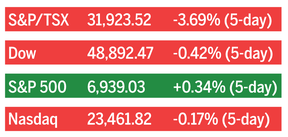

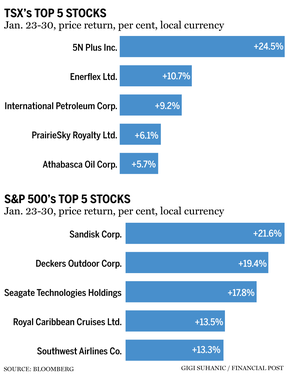

Keeping score

Article content

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

What does the drop in gold and silver have to do with Trump’s Fed pick?

Article content

Gold and silver plummeted Friday with bullion falling nearly 10 per cent to take it below US$5,000 an ounce and silver nosediving 26 per cent as the so-called debasement trade unwound. This is where investors hedge against currencies losing value with assets such as precious metals. The moves came after Donald Trump named Kevin Warsh as his pick to replace Jerome Powell as chair of the United States Federal Reserve. “The market reaction so far points to … independence fears regarding the Fed easing,” David Rosenberg, chief executive of Rosenberg Research & Associates Inc., said in a note on Friday. Markets had feared Trump would name a successor who would act in lockstep with his desire for more rate cuts, jeopardizing the Fed’s independence, which is a cornerstone of stock market activity. However, several notes on Warsh’s nomination described him as hawkish, which could make him more resistant to slashing interest rates. The U.S. dollar rebounded. Still, Rosenberg doesn’t think the fundamentals behind the price increases in gold and silver have changed that much. “The core issue is rising worries about fragmentation in the global market: the U.S. and China appear to be warehousing inventories rather than letting metal flow through global exchanges, stoking anxiety and speculative positioning.”

Article content

Article content

Article content

Raymond James’s best picks as Canada’s energy companies start to report Q4 earnings

Article content

Analysts at Raymond James Global Research updated their outlooks for the Canadian oil and gas companies based on revised commodity prices. The team of Michael Barth, Luke Davis, Justin Jenkins, Luke Konschuch and Brett Keller lowered their prices targets for West Texas Intermediate and Western Canadian Select by eight and 10 per cent for the fourth quarter of 2025, “which is a big driver of negative estimate revisions for producers this quarter,” the analysts said. Their “pecking order” for shares remained the same, with Cenovus Energy Inc. (CVE:TSX) their top pick followed by Suncor Energy Inc. (SU:TSX), Canadian Natural Resources Ltd. (CNQ:TSX). Imperial Oil Ltd. brought up the rear. “While we like CVE best longer term, we do note that SU has the most exciting story du jour, with a positive rate of change in the in situ business heading into the March Investor Day,” they said. Raymond James has a price target of $30 on Cenovus and a strong buy rating but expects most of the year to be more about the company digesting MEG Energy after its takeover. Cenvous closed Friday at $26.87. The team has a price target of $73 on Suncor and $53 on Canadian Natural on volume performance for the former and whether that results in lower unit costs and capital allocation for the latter. Shares closed Friday at $71.97 and $50.63, respectively. Raymond James has an underperform rating on Imperial and a price target of $106 with the analysts viewing the stock as “relatively expensive.” The stock closed Friday at $137.57.

.jpg) 14 hours ago

4

14 hours ago

4

English (US)

English (US)