Article content

Why Shopify is rebounding, how to dig for value behind ‘headline’ stock plays and more from The Week in Stocks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Stock of the week: Shopify Inc.

Article content

Article content

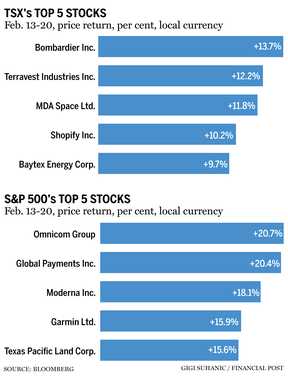

Shopfiy Inc. (SHOP:TSX) closed out the week up 10 per cent and among the top five gainers on the S&P/TSX composite index as investors continued to reevaluate their initial reactions to the e-commerce company’s earnings, which came out on Feb. 11. Despite delivering its highest quarterly revenue in 20 years, investors were spooked by an adjusted earnings per share miss and overall trepidation regarding AI, at one point pushing shares of Shopify down as much as 27 per cent intraday. That led a few analysts to jump to the shares’ defence. CIBC Capital Markets analysts Todd Coupland and Dylan Ridout said in a note that Shopify remained among their top picks with a price target of $250, trimmed back from $271. “We see upside from durable profitable growth with optionality from agentic e-commerce,” Coupland and Ridout said, arguing Shopify’s integration with OpenAI, Google’s Gemini and Microsoft’s Co-pilot positioned the company to benefit from those platforms rather than suffer displacement. Jefferies Equity Research analysts Samad Samana and Jeremy Sahler said the “negative stock price has surprised us” in a note following the earnings release. Since the earnings, several other investing houses also reaffirmed their price targets for Shopify, and this week’s market action seemed to bear that out, with the stock closing Friday at $172.89. The average 12-month price target based on 46 analysts tracked by Bloomberg is $215.02.

Article content

Article content

Keeping score

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Some possible winners from Canada’s new defence industrial strategy

Article content

The numbers in Canada’s just-announced defence industrial strategy are big: $180 billion in procurement and $290 billion in defence capital investment, spread out over 10 years, with Prime Minister Mark Carney pledging the strategy will prioritize the awarding of contracts to Canadian companies. “Our initial reaction is that the announced initiatives are highly constructive for our coverage, given the strong ‘Buy Canada’ focus, the targeted sectors/capabilities (in our coverage’s wheelhouse), the scale of planned investment and the decision to designate private sector firms as strategic partners,” Desjardins Group Capital Markets analysts Benoit Poirier and Michael Kypreos said in a note. Off the mark, Poirier and Kypreos believe companies that will benefit from the policy include Bombardier Inc. (BBD:TSX), CAE Inc. (CAE:TSX), Calian Group Ltd. (CGY:TSX), MDA Space Ltd. (MDA:TSX) and Kraken Robotics Inc. (PNG:TSX). Desjardins estimates that the plan to dedicate approximately 70 per cent of defence spending to Canadian companies will provide a $5.1 billion annual boost that could translate to roughly 300 defence contracts per year. The new policy targets 10 priority sectors including aerospace, a positive for Bombardier. Poirier and Kypreos expect MDA to benefit from a push in the areas of space-based intelligence, surveillance and reconnaissance, space domain awareness and satellite communications. On Thursday, MDA launched a wholly owned defence company, 49North Ltd. CAE and Calian are placed to benefit from specialized manufacturing, training and simulation, they said, while Kraken could win in the area of autonomous systems. Ottawa also plans to create a drone innovation hub, spending $105 million over three years. Company selections are expected to be announced this summer, Poirier and Kpyreos said.

Article content

Article content

Article content

How to find value in ‘behind the headline’ stocks

Article content

Sometimes there are gains to be made on the road less travelled. That’s the idea behind a theme-based stock screening system that Mehmet Beceren at Rosenberg Research & Associates Inc. said takes investors past the “headline names” to second- and third-tier companies that “may be less crowded, (have) less already priced in, and (are) better positioned to benefit as a market theme matures.” Beceren highlighted copper as one such investing theme. The price of copper has soared last year and into this year on fears of supply constraints, a lower U.S. dollar and geopolitical risk and miners have risen in tandem. The idea behind the stock screen is to find companies positioned to offer key technologies, materials, or services but that are playing catch-up to the copper theme trade. Based on that, Rosenberg Research created a global copper miner supply chain basket of 24 names. Among the TSX-listed names are Finning International Inc. (FTT:TSX), Fortis Inc. (FTS:TSX), Mattr Corp. (MATR:TSX), Major Drilling Group International (MDI:TSX) and Orbit Garant Drilling Inc. (OGD:TSX). There are also names on the list from Australia, the U.S., Mexico, Japan, Sweden and Germany. “Year-to-date, the upstream miners supply-chain basket has outperformed a generic copper miners portfolio, as second- and third-order effects start to play out — and as investors look for more diversified, better-priced ways to express exposure to a popular theme,” Becerent said.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)