Article content

(Bloomberg) — Two years ago, when Glencore Plc proposed an unsolicited, $23 billion takeover of Teck Resources Ltd., the Canadian miner’s founder decisively rejected the idea. “Now is not the time,” Norman Keevil Jr. said back then.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

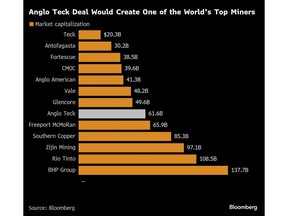

Fast forward to 2025, and the 87-year-old Keevil is one of the chief proponents of a mammoth deal to combine Teck with London-based Anglo American Plc. The merger would create a roughly $60 billion company and one of the world’s top copper producers. But both companies describe it as a zero premium deal, in contrast to Glencore’s proposal, which initially offered a 20% takeover premium.

Article content

Article content

Article content

Leaving that money on the table was the price Keevil was willing to pay to keep the company headquartered in Canada. The industry veteran, who built Teck with his father about six decades ago, is also the controlling shareholder, giving him significant sway over Canada’s largest diversified mining company. He played a crucial role in negotiating the merger with Anglo, according to people familiar with the matter.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

While the structure of the deal was largely decided among the firms’ bankers and corporate development teams, the negotiators were careful not to run afoul of Keevil, knowing his aversion to a takeover that would erase the Teck brand and allow it to be swallowed by a bigger, foreign company. Certain key concessions were made at Keevil’s behest, including the agreement to headquarter the company in Canada, said the people, who asked not to be identified discussing internal debates.

Article content

Keevil wanted to get a deal done sooner rather than later because his grip on the company was weakening, according to the people. In 2023, amid Glencore’s takeover attempt, Teck shareholders approved an arrangement that would see Keevil’s controlling stake wind down by 2029, after which he’d lose any ability to sink a takeover that other investors favored.

Article content

Article content

With that expiration date looming, Keevil was eager to protect his legacy and Teck’s status as a Canadian company.

Article content

“The longer Norm waited to make a deal, the less ability he would have to shape it,” said Pierre Gratton, president of the Mining Association of Canada.

Article content

Teck and Anglo didn’t respond to requests for comment. In an email to Bloomberg News, Keevil said the deal was “the right thing to do.”

Article content

“It merges two mid-level, international copper miners into a single top-tier one, stronger than either alone, and with its global operating headquarters and top management based right here in Canada,” Keevil wrote. “Before, Canada had never had that. Now we will.”

Article content

The accord included a promise for at least C$4.5 billion ($3.3 billion) of investment in Canada over five years.

Article content

Pledges by the companies to have Vancouver as the global head office and to invest further in Canadian projects constitute a “home run,” British Columbia Premier David Eby said in an interview last week. “It’s an incredible opportunity for British Columbia and Canada and I’ll be delivering that message directly to the federal government as they do their assessment of this bid.”

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)