Article content

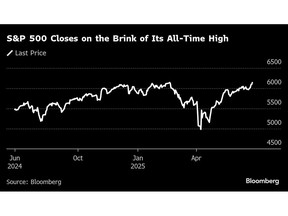

(Bloomberg) — Asian stocks were set to advance after a gauge of global equities touched a record high Thursday on calming geopolitical concerns and increased expectations for Federal Reserve rate cuts this year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Equity index futures in Japan, Australia and Hong Kong were all higher early Friday after the S&P 500 advanced 0.8% to within striking distance of a new high. The Nasdaq 100 achieved the feat after rising 0.9%, helping MSCI’s global shares index to a record high. Contracts for US equities edged higher early Friday.

Article content

Article content

Article content

Treasuries rallied across the curve as traders increased expectations for Fed cuts. The swaps market has fully priced two further rate reductions this year and on Thursday increased expectations for a third.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The stock market is back at record highs as various uncertainties start to fade,” said Paul Stanley at Granite Bay Wealth Management. “The market is betting on continued progress on trade, and a de-escalation of tensions in the Middle East is giving investors confidence.”

Article content

The moves were driven by US economic data that supported the case for policy easing. Consumer spending grew in the first quarter at the weakest pace since the onset of the pandemic. As a result, gross domestic product slid at a downwardly revised 0.5% annualized rate. Recurring applications for unemployment benefits rose to the highest since 2021 — but initial claims fell.

Article content

An index of the dollar weakened Thursday as US yields fell. The decline supported the yen and a third daily advance for a gauge of emerging markets currencies. West Texas Intermediate, the US oil price, rose 0.5% Thursday, its smallest swing this week, in a sign of relative calm in the Middle East.

Article content

Article content

The cross-asset moves show that investors are looking beyond the near-term volatility spurred by tariffs and war to instead focus on central bank policy and the health of the US economy. After markets closed in New York on Thursday, US Commerce Secretary Howard Lutnick said the US and China had finalized an understanding on trade following talks last month.

Article content

Stock-market volatility is likely to remain higher in the second half of the year given lingering macro and policy uncertainty, according to Goldman Sachs Group Inc. strategists. The team led by Andrea Ferrario says stagflationary shocks remain a key risk for balanced portfolios amid tariff-induced inflation risks.

Article content

Meanwhile, the Treasury Department announced a deal with G-7 allies that will exclude US companies from some taxes imposed by other countries in exchange for removing the “revenge tax” proposal from President Donald Trump’s tax bill.

Article content

In Asia, economic data set for release includes retail sales and Tokyo inflation for Japan, trade for the Philippines and industrial profits in China. Markets are closed in Indonesia and Malaysia.

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)