Article content

(Bloomberg) — Shell Plc said it has no intention of making a takeover offer for BP Plc, refuting an earlier report that two of Europe’s biggest companies were in active merger talks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

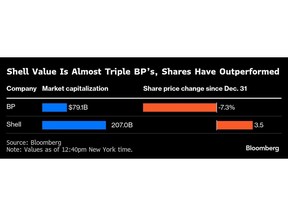

The announcement quells speculation that the UK’s two oil majors would end up combining, following several years of poor performance from BP and rising pressure from activist shareholder Elliot Investment Management. Shell’s statement means it is bound by the UK Takeover Code, largely preventing it from submitting an offer for BP for six months.

Article content

Article content

Article content

“In response to recent media speculation, Shell wishes to clarify that it has not been actively considering making an offer for BP,” it said in a statement on Thursday. The company “has not made an approach to, and no talks have taken place with, BP with regards to a possible offer.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

BP’s shares jumped as much as 10% in New York on Wednesday after the Wall Street Journal reported that the company was in early-stage takeover talks with its larger rival. The stock pared gains as Shell swiftly dismissed the report as “market speculation.”

Article content

BP’s prolonged period of under-performance stems in large part from a net zero strategy embraced by former Chief Executive Officer Bernard Looney. He left the company in 2023 over his personal conduct leaving his successor, Murray Auchincloss, to grapple with a failing clean-energy strategy.

Article content

Auchincloss announced a “reset” in February that included a pivot back to oil and gas, a reduction in share buybacks and promises to sell assets and pay down debt. The new strategy got a lukewarm reception from many investors, and didn’t go far enough for Elliott, which has continued to push for more radical change.

Article content

Article content

It was against this backdrop that BP became seen increasingly as a potential takeover target. Although no company came forward with an offer, several of BP’s peers and rivals were said to be appraising the situation behind closed doors.

Article content

Bloomberg reported in May that Shell had been studying the merits of a takeover, but was waiting for further stock and oil price declines before deciding whether to pursue a bid. Abu Dhabi’s main oil company has evaluated whether it could buy some of BP’s key assets should the British firm decide to break itself up or come under pressure to divest more units, Bloomberg reported earlier in June.

Article content

While Shell’s statement douses the majority of the takeover speculation related to BP, the six-month standstill under UK takeover rules isn’t absolute. It could end early under a limited number of exceptional circumstances, including if BP receives an offer from another suitor or invites a fresh approach, or there is a “material change” of circumstances.

Article content

And major changes at BP are set to continue. The company is searching for a new board chairman after Helge Lund announced in April his intention to step down. Lund’s role as a key backer of the net zero strategy made him focus of criticism from Elliott, which remains one of BP’s largest shareholders.

Article content

—With assistance from Aaron Kirchfeld and Phil Kuntz.

Article content

(Updates with context throughout.)

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)