Article content

(Bloomberg) — Earnings reports from some of the largest US manufacturers and transportation companies this week drove home how President Donald Trump’s policies on trade and energy are putting a squeeze on the sector’s profits.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Caterpillar Inc, which imports raw materials and parts for construction equipment, said it expects the president’s levies to cost about $2.6 billion this year. Railroad Norfolk Southern Corp. said trade policy is eroding demand for some of its business lines, and shipping giant United Parcel Service Inc. said trade flows are shifting in a way that’s pressuring margins.

Article content

Article content

Article content

Meanwhile, on the energy front, power-equipment company GE Vernova Inc. took a hit last month after the Trump administration required work to stop on a wind farm off the coast of Massachusetts. Its wind business recorded a wider-than-forecast $225 million loss last quarter.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

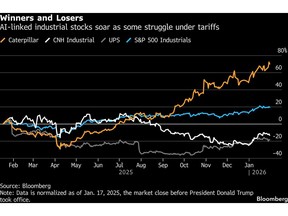

The sector overall has been handily beating the broader stock market in the past two months as investors see it benefiting from the artificial-intelligence boom. However, the strains that were apparent in this week’s results show how Trump’s efforts to boost American manufacturing are cutting both ways for some producing headwinds for their business as they await more advantageous tax-related policies to kick in.

Article content

“The policy cadence has been more foe than friend for industrials in the near term,” said Joe Gilbert, a portfolio manager at Integrity Asset Management. “Industrials have taken their medicine first with tariffs and policy halts and the candy — tax expensing — will come later.”

Article content

Gilbert says he’s positive on transportation and machinery stocks, expecting them to benefit from growth in the industrial economy.

Article content

Article content

Industrial stocks have had the of wind at their back lately.

Article content

Some of that is thanks to Trump and Congress, led by his fellow Republicans: Last year’s tax and spending bill included immediate expensing for investments, a provision that favored the sector directly. Investors are also anticipating that higher refunds this tax season will buoy consumers and brighten the US economic outlook, helping these companies.

Article content

Another big catalyst: AI euphoria. Caterpillar and GE Vernova are seeing strong demand for their power-generation equipment, which drove up their stocks after this week’s reports. GE Vernova said it’s in frequent talks with the White House about ramping up production of its natural-gas turbines.

Article content

For investors, GE Vernova’s AI-driven strength has offset the pressure from a wind segment that it expects to keep losing money this year. To be sure, a federal judge ruled this week that a project off of Martha’s Vineyard could go forward.

Article content

Still, the unit’s “substantial headwinds” weighed on guidance for the year, Colin Rusch, an analyst at Oppenheimer, wrote in a note to clients. At the same time, he said demand in its power and electrification businesses is beating expectations.

.jpg) 20 hours ago

4

20 hours ago

4

English (US)

English (US)