Article content

(Bloomberg) — Singapore’s central bank is expected to hold policy settings steady for a third straight review, though economists see scope for a hawkish pivot as inflation shows signs of gaining momentum.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Nineteen out of 20 economists in a Bloomberg survey forecast the Monetary Authority of Singapore will maintain its policy settings Thursday. Bank of America Corp. is alone in predicting a tightening this week while United Overseas Bank Ltd. reckons a “preemptive” move cannot be ruled out.

Article content

Article content

Article content

Nine of the 13 respondents expect a hawkish bias in the statement, with four predicting no change to the tone.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

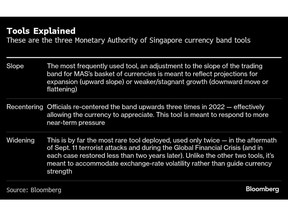

The MAS, which holds four policy reviews per year, had left its setting unchanged since last easing in April 2025 to help support growth. Unlike most central banks, which use interest rates, Singapore seeks to maintain medium-term price stability by managing its dollar’s trade-weighted appreciation within a target band.

Article content

Thursday’s decision follows inflation data for December which showed consumer prices remained elevated for a third straight month, driven by healthcare, education and food. The figures suggest that price “momentum is picking up,” said Selena Ling, chief economist at Oversea-Chinese Banking Corp Ltd.

Article content

“Looking ahead, the official rhetoric may be beginning to tilt from a neutral balanced stance to a slightly more hawkish tone,” she added.

Article content

The MAS will update their forecast ranges for 2026 core and all-items inflation at the review on Thursday. Both gauges are projected to rise in 2026 from their low rates last year, the central bank said in a statement last week.

Article content

Article content

That “rare heads-up” prompted economists at BofA to switch their call to now predict a 50-basis point steepening of the policy slope on Thursday, economists Kai Wei Ang and Rahul Bajoria wrote in a note.

Article content

The MAS review comes as central banks globally adopt divergent paths — emerging Asian economies are expected to lower borrowing costs, Japan, Canada and Australia are seen hiking, while the euro zone will likely leave rates unchanged. The US Federal Reserve, meanwhile, may ease settings further.

Article content

However, as with 2025, geopolitics and US trade policies may easily jolt the outlook as central banks feel their way through the economic fog stoked by Donald Trump’s second year at the White House.

Article content

What Bloomberg Economics Says…

Article content

“Growth in 2025 was much stronger than expected, accelerating from an already-firm 4.4% pace in 2024. This was due to multiple factors that countered headwinds from an adverse base effect and US tariff upheaval. Meantime, inflation is low. Altogether, this suggests the policy setting is about right.”

Article content

— Tamara Mast Henderson, economist.

Article content

— For the full note, click here.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)