Article content

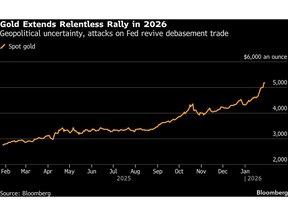

(Bloomberg) — Gold steadied after seven days of gains, with traders digesting a record-breaking rally fueled by US dollar weakness and a flight from sovereign bonds and currencies.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Bullion was near $5,160 an ounce, having risen 3.4% on Tuesday — its biggest one-day gain since April. President Donald Trump said he was not concerned about a drop in the value of the dollar that has dragged the world’s premier reserve currency to its weakest level in nearly four years.

Article content

Article content

Article content

That decline, combined with heightened geopolitical risks and investor flight from currencies and Treasuries, has sparked a wave of investment demand in precious metals. Gold has gained nearly 20% since the beginning of the year, smashing through $5,000 an ounce for the first time this week before advancing to a record of $5,190.41. In the same period, silver has surged more than 50%.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

A massive selloff in the Japanese bond market is the latest example of concerns over heavy fiscal spending, while speculation that the US may intervene to support the yen has weighed on the dollar, making precious metals cheaper for most buyers. A gauge of the US currency fell 1.1% on Tuesday, its biggest one-day drop since April.

Article content

Trump told reporters in Iowa on Tuesday that the dollar was “doing great” and he expected currency values to fluctuate. “No, I think it’s great,” he told reporters when asked if he was worried about losses in the currency.

Article content

The Trump administration’s actions — threats to annex Greenland and military intervention in Venezuela, as well as renewed attacks on the Federal Reserve’s independence — have also unsettled markets in recent weeks. The US leader has threatened to hike tariffs on South Korean goods and to impose 100% tariffs on Canada if Ottawa reaches a trade deal with China.

Article content

Article content

Meanwhile, bond traders are ramping up bets on a dovish policy shift at the Fed on the expectation that BlackRock Inc. Chief Investment Officer Rick Rieder will succeed Jerome Powell as chair. The Wall Street veteran has advocated for an aggressive approach to lower borrowing costs. A lower rate environment benefits precious metals, which don’t pay interest.

Article content

Expectations of a more dovish and less independent Fed, as well as geopolitical risks, “are likely driving more rapid allocations to gold, led by retail investors,” Suki Cooper, global head of commodities research at Standard Chartered Plc, said in a note. “Barring short-term corrections, we continue to see further upside risk.”

Article content

Gold edged down 0.4% to $5,161.36 an ounce as of 8:21 a.m. in Singapore. Silver rose 0.3% to $112.34. Platinum and palladium fell, while the Bloomberg Dollar Spot Index was up 0.2% on Wednesday but down 1.4% for the week.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)