Article content

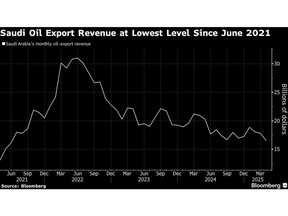

(Bloomberg) — Saudi Arabia’s revenue from oil exports slumped to the lowest in almost four years in April as crude prices crashed.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Proceeds from the sale of crude oil and refined products declined to $16.5 billion, according to data released from the country’s main statistics body. That’s down about 21% year-on-year and 7% from the prior month.

Article content

Article content

Crude prices plunged in April, with benchmark Brent dropping more than 15% that month to a four-year low after US President Donald Trump unveiled global trade tariffs. Within hours of that decision, OPEC+ shocked energy traders by saying it would speed up plans to raise oil output, delivering a double-whammy to markets.

Article content

Article content

Brent has somewhat recovered since — now trading around $68 a barrel — as traders weigh up potential supply threats from geopolitical tensions, among other things. Still, prices in London are down about 9% so far this year, after having given up gains from the Israel-Iran conflict following the truce reached between the two countries this week.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Depressed oil prices heap further pressure on Saudi Arabia’s finances as the government continues to spend heavily on Crown Prince Mohammed bin Salman’s Vision 2030 strategy, and runs deeper budget shortfalls. Prices around $65 risk further widening fiscal and current account deficits and increasing financing needs and public debt levels, according to Mohamed Abu Basha, head of macro analysis at EFG Hermes.

Article content

“Such pressures are manageable in the short-term, considering the kingdom’s strong balance sheet and access to credit,” said Abu Basha. “Low oil price for longer would most likely require a combination of a revisit to spending plans and implementation of fiscal consolidation measures.”

Article content

OPEC and its allies, led in large part by Saudi Arabia, are scheduled to meet next on July 6 to decide on production levels for August. The kingdom is keen for the group to continue with accelerated supply boosts of 411,000 barrels a day, following on from similar hikes in May, June and July, people familiar with the matter said this month.

Article content

Oil watchers will keenly focus on that meeting for signals on where the market is heading next. While output has held up during the Middle East conflict, growth in consumption in top buyer China has remained muted.

Article content

—With assistance from Salma El Wardany and Rakteem Katakey.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)