Article content

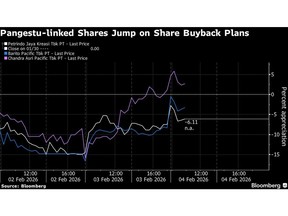

(Bloomberg) — Companies linked to Indonesian billionaire Prajogo Pangestu said they would buy back shares, in a bid to shore up prices after last week’s market meltdown.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

PT Barito Pacific, PT Chandra Asri Pacific and PT Petrindo Jaya Kreasi plan share repurchases of as much as a combined 3.75 trillion rupiah ($224 million), according to filings to the Indonesia Stock Exchange on Tuesday and Wednesday. The companies will buy shares from Feb. 4 to May 3.

Article content

Article content

Article content

Shares of Barito Pacific jumped as much as 9.6%, the most since Sept. 24, following the announcements. Chandra Asri and Petrindo Jaya Kreasi also gained.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“In light of the recent market volatility, the Group’s management believes that its immediate priority is to help support market stability while reaffirming our full commitment to the group’s long-term strategic business expansion,” said a Barito Pacific spokesperson in an email response for comment. With regards to new requirements to raise minimum free float to 15% from 7.5%, “we are closely monitoring ongoing regulatory developments and will await further regulatory guidance,” the spokesperson said.

Article content

The share buybacks come as Indonesia’s market saw its worst two-day rout in nearly three decades at one point last week, spurred by MSCI Inc.’s concerns over investability and warning of a potential downgrade to frontier-market status. Prajogo-owned firms were among the hardest hit in the selloff, whose net worth dropped by around $9 billion after his energy and mining companies slid.

Article content

“The Indonesian tycoons are trying to signal the market that their stocks are cheap. It is a show of confidence,” said John Foo, founder of Valverde Investment Partners Pte. “The next few weeks will be uncertain due to the MSCI overhang.”

Article content

Article content

At the heart of MSCI’s concerns is the low free float of Indonesian equities. Many of the country’s largest companies are thinly traded and controlled by a small number of wealthy individuals — a structure that investors say distorts index performance and increases the risk of manipulation. The issue has been a point of contention for years, with critics arguing that low liquidity renders large portions of the market uninvestable and difficult to track.

Article content

Companies with concentrated ownership include Petrindo Jaya Kreasi, which is 84% owned by Prajogo, and Barito Pacific, in which he holds a 71% stake, according to their latest filings.

Article content

—With assistance from Bernadette Toh.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)