Article content

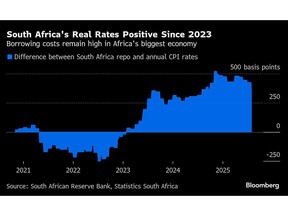

(Bloomberg) — South Africa is paying more to borrow than its emerging-market peers because the slow pace of reforms is dampening economic growth, according to Moody’s Ratings.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

“We think these are the issues that are weighing on the cost of debt,” said Moody’s Senior Vice President Lucie Villa. Investors feel that while South Africa is “not on the verge of a crisis, there is this kind of slow deterioration happening and that, no matter what — even with a leadership that is trying to address this issue — it’s proving very, very challenging,” she said.

Article content

Article content

Article content

Long-term rates in South Africa exceed those in most emerging-market economies except Brazil and Mexico, Moody’s data show.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Africa’s largest economy has grown less than 1% on average annually for more than a decade, hamstrung by disintegrating infrastructure, graft, crime, logistics and energy constraints. A study conducted by Investec Wealth & Investment International found that the economy is at least 37% smaller than it would have been had it tracked its EM peers and sustained annual growth of 4.5% since 2010.

Article content

A coalition government formed by the African National Congress after it lost its outright majority in last year’s elections hasn’t managed to significantly accelerate reforms to speed up growth.

Article content

The low growth has denied the country much needed tax revenues, leaving it reliant on external funding, Moody’s said.

Article content

“You have high debt costs, and then the government wants to do something to revive its economy and private sector,” Villa said. “But to do that, they need to invest. And to invest, they have to borrow, and they are borrowing at high rates.” This results “in a negative feedback loop that is difficult to break,” she said.

Article content

Article content

The country’s ratio of debt to gross domestic product has more than doubled over the past 15 years and the National Treasury expects it to peak in the current fiscal year ending March 31 at 77.4%.

Article content

Some of the solutions Moody’s proposes include hastening the implementation of reforms to improve the operation and management of critical industries like electricity, water, and transport and rationalize borrowing.

Article content

The state should also seek concessional funding from development partners to help lower foreign-currency costs where possible, the agency said.

Article content

“Mixing normal debt with debt that is less expensive, limiting the amount of borrowing during the bridge period, and pushing in on your medium-term reform agenda” could put the country back on track, Villa said.

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)