Article content

PEA outlines base case production averaging 1.4 Mlb U₃O₈ annually over a 13-year mine life for total output of 18.1 Mlb with an after-tax NPV (8%) of US$83.9M, with strong leverage to higher uranium prices and increased recovery

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

TORONTO, Oct. 30, 2025 (GLOBE NEWSWIRE) — Premier American Uranium Inc. (“PUR” or “Premier American Uranium” or the “Company”) (TSXV: PUR, OTCQB: PAUIF) is pleased to announce the results of its Preliminary Economic Assessment (“PEA”) for the Cebolleta Uranium Project (“Cebolleta” or the “Project”) in New Mexico. The PEA highlights the potential for a large-scale, long-life, low-capex uranium project with leverage to rising uranium prices. The PEA contemplates a heap leach strategy that produces a uranium-loaded resin that would be suitable for off-site processing at multiple under-utilized licensed domestic in-Situ Recovery (ISR) central processing plants, enabling potential development without reliance on legacy conventional mills. Preliminary economics are believed to have strong potential to be enhanced near-term with advanced metallurgical testing and process optimization.

Article content

Article content

Article content

The updated Mineral Resource Estimate (“MRE”) for Cebolleta increases Indicated Mineral Resources by 1.7 Mlb eU3O8 (+9%) to 20.3 Mlb eU3O8 and increases Inferred Mineral Resources by 2.2 Mlb eU3O8 (+45%) to 7.0 Mlb eU3O8, compared to the previous technical report on the Project released in April 2024 (the “2024 Technical Report”). The updated MRE positions Cebolleta as one of the largest undeveloped uranium deposits in the western United States. The PEA and MRE are included in a Technical Report (the “Technical Report”) prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“) by SLR International Corporation (“SLR“), an independent consulting firm with extensive experience in mining and mineral processing, including uranium operations in the United States.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized.

Article content

Article content

Highlights

Article content

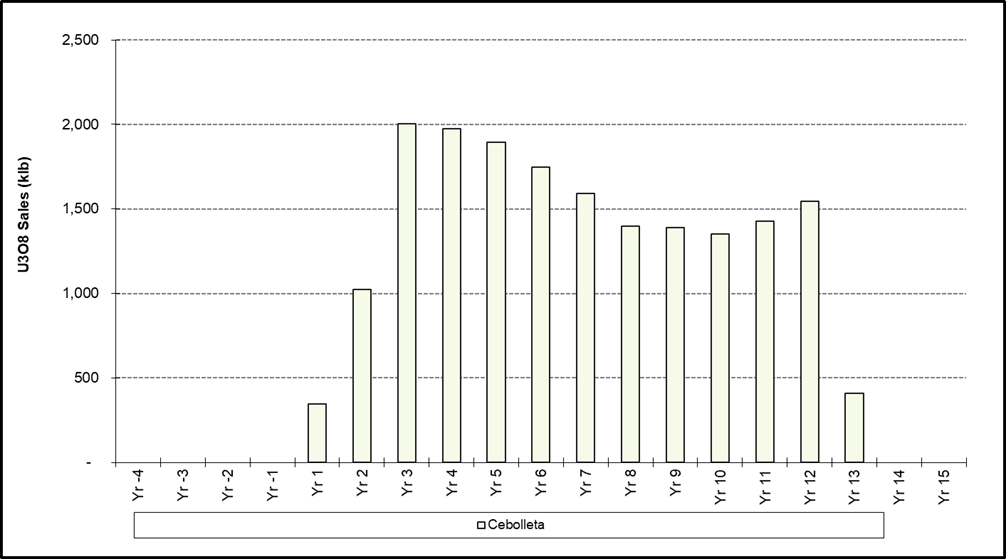

- Base case mining concept shows Cebolleta average production of 1.4 Mlb U₃O₈ annually (peak of 2.0 Mlb) for a total of 18.1 Mlb over its 13-year mine life.

- After-tax net present value (“NPV”) (8%) of US$83.9M (US$106M pre-tax)

- After-tax IRR of 17.7%

- Pre-production costs:

- Direct CAPEX of US$64.2M

- Indirect (EPCM / Owners cost / Indirect) of US$19.3M

- 35% contingency of US$29.2M

- Life of Mine (“LOM”) after-tax free cash flow of US$287M

- LOM operating cashflow of US$496M

- Average operating cost of US$41.60 per lb U3O8 recovered

- Relatively low operating costs are underpinned by very competitive heap leach processing costs of US$16.72 per short ton

- Average operating cost of US$41.60 per lb U3O8 recovered

- Base case uranium price assumption of US$90/lb U₃O₈

- Strong leverage to uranium prices, with higher prices expected to potentially further enhance project economics and cash flow generation. Uranium price sensitivity analysis shows after-tax NPV (8%) could reach:

- US$154M at US$100/lb U₃O₈

- US$325M at US$125/lb U₃O₈

- US$488M at US$150/lb U₃O₈

- Upside potential with improved metallurgical recoveries – Sensitivity analysis indicates that base-case after-tax NPV (8%) of US$84M, increases by approximately 90% to US$159M using a 90% metallurgical recovery assumption.

- Updated MRE significantly increases total Project mineral resources:

- Indicated resource: 20.3 Mlb eU3O8 (8.3 Mst grading 0.12% eU3O8), up 1.7 Mlb eU3O8 or 9% vs. 2024 Technical Report

- Inferred resource: 7.0 Mlb eU3O8 (3.6 Mst grading 0.10% eU3O8), up 2.1 Mlb eU3O8 or 43% vs. 2024 Technical Report

Advertisement 1

Advertisement 2

Article content

Colin Healey, CEO and Director of Premier American Uranium, commented, “The PEA highlights that Cebolleta has the potential to be a cornerstone U.S. uranium project with a long mine life, low upfront capital, and strong leverage to higher uranium prices. Alongside the PEA, the updated MRE significantly increases project-wide resources, reflecting another successful deliverable for our team. With a clear pathway to optimizing embedded process assumptions through additional metallurgical studies, and exploration upside potential, we see an opportunity to rapidly de-risk and increase project value, as we advance Cebolleta toward potential development. We believe these next steps have the potential to position Cebolleta as a critical contributor to U.S. energy independence.”

Article content

Table 1: Summary of Key Economic Parameters – Base Case

Article content

| Description | US$ million |

| Realized Market Prices | |

| U3O8 ($/lb) | $90 |

| Payable Metal | |

| U3O8 (klb) | 18,101 |

| Total Gross Revenue | $1,629 |

| Mining Cost | $(705) |

| Mill Feed Transport Cost | $(1) |

| Process Cost | $(175) |

| G & A Cost | $(76) |

| Royalties | $(98) |

| Severance Tax | $(29) |

| Total Operating Costs | $(1,085) |

| Operating Margin (EBITDA) | $545 |

| Operating Margin % | 33% |

| Corporate Income Tax | $(48) |

| Working Capital* | $0 |

| Operating Cash Flow | $496 |

| Development Capital | $(113) |

| Sustaining Capital | $(81) |

| Closure/Reclamation | $(16) |

| Total Capital | $(209) |

| Pre-tax Free Cash Flow | $335.4 |

| Pre-tax NPV @ 5% | $166.8 |

| Pre-tax NPV @ 8% | $106.3 |

| Pre-tax NPV @ 12% | $53.3 |

| Pre-tax IRR | 19.8% |

| Pre-tax Undiscounted Payback from Start of Commercial Production (Years) | 4.3 |

| After-tax Free Cash Flow | $286.9 |

| After-tax NPV @ 5% | $137.3 |

| After-tax NPV @ 8% | $83.9 |

| After-tax NPV @ 12% | $37.3 |

| After-tax IRR | 17.7% |

| After-tax Undiscounted Payback from Start of Commercial Production (Years) | 4.9 |

Article content

Article content

Sensitivity Analysis

Article content

Sensitivity analysis of the Cebolleta PEA indicates strong leverage to uranium price, where a 11% increase to the base case assumption (US$90/lb U3O8) to US$100/lb, increases after-tax NPV (8%) by 83%, to US$154M. Given the current market growth expectations for the uranium sector and recent (2024 peak UxC Spot uranium price: US$107/lb U3O8) and leading uranium price indicators, (UxC 5-year price: US$94/lb U3O8), sensitivity at higher prices was also examined. At US$125/lb U3O8, the after-tax project NPV (8%) increases to US$325M (39% increase in uranium price increases post-tax NPV (8%) by 288%).

Article content

Also notable, is the leverage to metallurgical recovery assumption, where a 2.5% increase from 80% recovery to 82%, increases post-tax NPV (8%) by 19%, to US$99.6M. Increasing recovery by 12% (from 80% recovery to 90%) increases after-tax NPV (8%) by 90%, to US$159M. Standard uranium project sensitivities to various inputs are tabled below.

Article content

Table 2: After-Tax Sensitivity Analyses (deviation from base-case)

Article content

| Variance | Metal Prices (US$/lb U3O8) | NPV at 8% (US$000) | |||

| 78% | $70 | ($57,384) | |||

| 89% | $80 | $14,410 | |||

| 100% | $90 | $83,857 | |||

| 111% | $100 | $153,718 | |||

| 122% | $110 | $222,911 | |||

| 139% | $125 | $325,391 | |||

| 167% | $150 | $487,514 | |||

| Variance | Recovery (%) | NPV at 8% (US$000) | |||

| 95% | 64% | ($41,713) | |||

| 98% | 72% | $21,288 | |||

| 100% | 80% | $83,857 | |||

| 103% | 82% | $99,590 | |||

| 112% | 90% | $159,261 | |||

| Variance | LOM Total Operating Costs (US$/ton cumulative) | NPV at 8% (US$000) | |||

| 85% | $804,491 | $145,076 | |||

| 93% | $875,476 | $114,522 | |||

| 100% | $946,460 | $83,857 | |||

| 118% | $1,112,091 | $12,696 | |||

| 135% | $1,277,721 | ($61,750) | |||

| Variance | LOM Total Capital Costs (US$000) | NPV at 8% (US$000) | |||

| 85% | $190,546 | $105,766 | |||

| 93% | $207,359 | $94,812 | |||

| 100% | $224,172 | $83,857 | |||

| 118% | $263,402 | $58,297 | |||

| 135% | $302,633 | $32,736 | |||

Article content

Article content

Mineral Resource Estimate

Article content

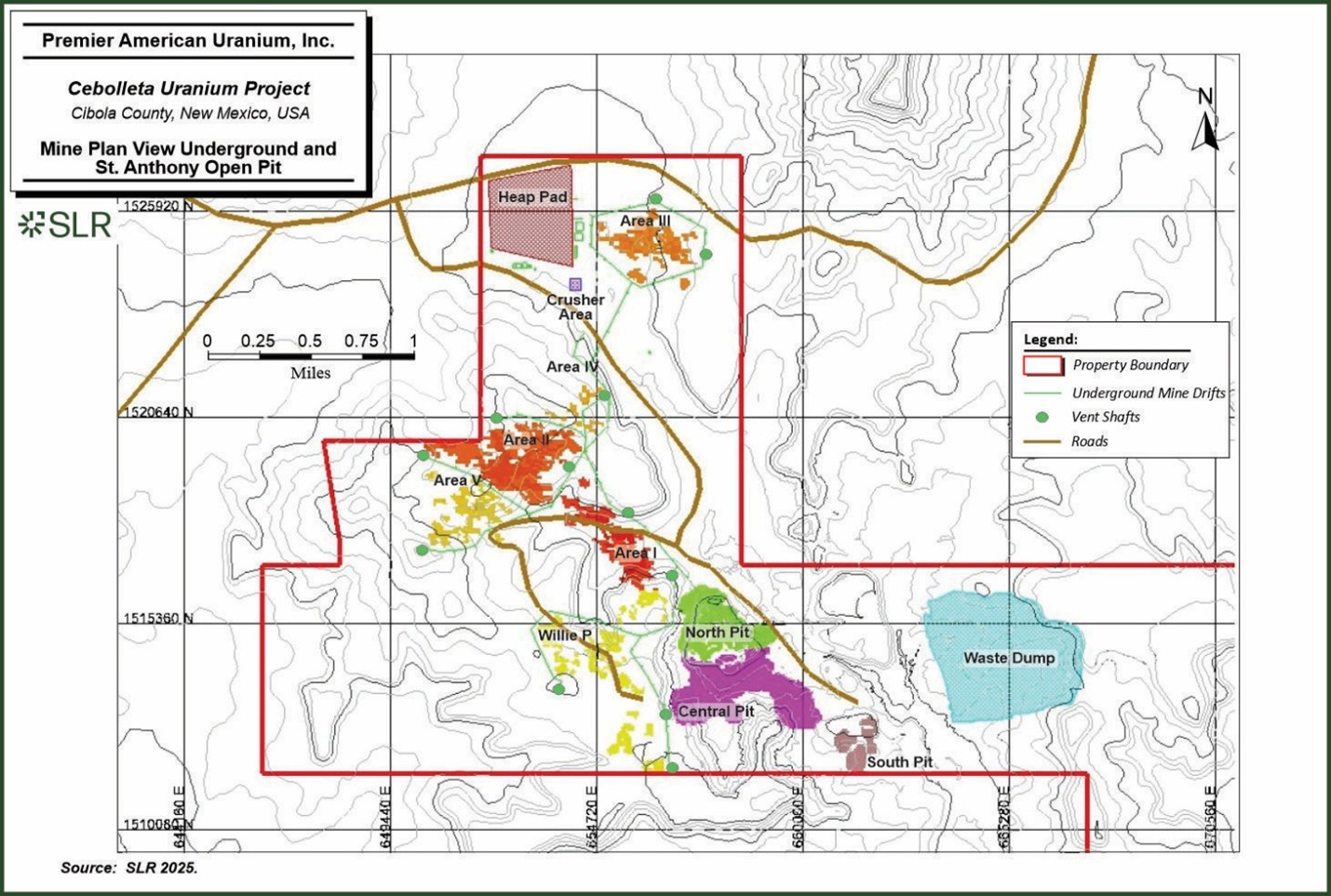

The Cebolleta Uranium Project is underlain by Upper Jurassic Morrison Formation units, particularly the Jackpile Sandstone Member, which hosts the majority of uranium mineralization. The mineralization is primarily stratabound and tabular, hosted within medium- to coarse-grained, humate-rich fluvial sandstones of the Jackpile Sandstone. Mineralization is primarily hosted in the relatively flat laying Jackpile Sandstone at depths below the surface of 0 ft to 500 ft. The Project is composed of the St. Anthony, Willie P, and Areas I, II, III, IV, and V mining areas.

Article content

Historical exploration, including over 4,000 drill holes and multiple mining operations (Willie P, Climax M-6, St. Anthony, and Sohio JJ#1), has established a robust geologic and mineralization framework for the Project.

Article content

A modern confirmation drilling program conducted in 2023 validated historical drilling data, confirming stratigraphy, mineralization thickness, and grades. Results support the use of legacy data in current resource estimation.

Article content

The MRE incorporates over 3,300 validated drill holes totaling greater than 1.7 million feet and is summarized below.

Article content

SLR is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MRE.

Article content

Table 3: Mineral Resource Estimate – Cebolleta Uranium Project – Effective May 14, 2025

Article content

| Classification | Grade Cut-off (% eU3O8) | Tonnage (Mst) | Grade (% eU3O8) | Contained Metal (Mlb eU3O8) |

| Indicated | ||||

| Underground | 0.00 | 5.89 | 0.15 | 18.14 |

| Open Pit | 0.02 | 3.81 | 0.07 | 5.61 |

| Subtotal Indicated | 9.70 | 0.12 | 23.75 | |

| Depletion | -1.40 | 0.12 | -3.44 | |

| Total Indicated less Depletion | 8.30 | 0.12 | 20.31 | |

| Inferred | ||||

| Underground | 0.00 | 1.79 | 0.12 | 4.42 |

| Open Pit | 0.02 | 1.81 | 0.07 | 2.62 |

| Total Inferred | 3.60 | 0.10 | 7.04 | |

Notes:

| ||||

Article content

Article content

Mine Plan Overview and Mineable Resources

Article content

The PEA contemplates a two-year underground pre-production period and a 13-year active mine life comprised of underground and open pit mining across seven mining zones (St. Anthony, Willie P, and Areas I, II, III, IV, and V). The primary mining methods expected to be employed at Cebolleta will be open pit (St. Anthony Area) and room and pillar (Areas I, II, III, IV, V and Willie P, St. Anthony North and South Zones).

Article content

The mine plan, which is based on Indicated and Inferred Mineral Resources, includes a total of 8.30 million short tons (Mst) at 0.12% eU₃O₈ containing 20.31 million pounds (Mlb) eU₃O₈ Indicated and 3.60 Mst at 0.10% eU₃O₈ containing 7.04 Mlb eU₃O₈ Inferred.

Article content

The underground mining areas will be accessed by a 3,500-ft long adit decline starting near the heap pad location for Area III, with a 2,500-ft long extension of this decline to access Area II. There will be a second access to the underground mining at Area I and Willie P, which will be a 930-ft long adit starting at a location in the northwest corner of the St. Anthony open pit. These two underground accesses will be connected by a 3,800-ft long drift. A minimum mining thickness of six feet was applied to two-foot-thick mining blocks. An underground 85% mining recovery was applied to the Mineral Resource Estimate reporting panels with underground panel dilution expected to be 21%. PUR is acutely aware of the need to keep dilution low, given the high cost of mining and treatment.

Article content

Article content

Over the LOM, mining is expected to supply total process feed of 10.46 Mst with an average head grade of 0.11% eU3O8. Mining rates are anticipated to be 1,079 short tons per day (“stpd”) from underground and 1,982 stpd from open pit operations.

Article content

It is envisioned that Cebolleta will supply approximately 1.1 million short tons of mineralized material per year to PUR’s heap leach pad (“HLP”) located on the Cebolleta property.

Article content

Figure 1: Mine Plan View – Cebolleta Uranium Project Open Pit and Underground

Article content

Article content

Article content

Article content

Processing Overview

Article content

Mineralized material will be crushed via mobile crusher in 2-stages to a 2-inch crush size and stacked in lifts on an HLP and irrigated with dilute sulfuric acid solution for uranium leaching. The LOM average head grade is 0.11% U3O8, and the process design U3O8 head grade is 0.140% with the nominal leach recovery assumed at 80%.

Article content

Leached uranium is collected as a pregnant leach solution (“PLS”) and processed via ion exchange columns containing resin. The uranium in the PLS will load onto the resin with the resultant barren solution recycled back to the heap leach for additional leaching cycles. Loaded resin columns will be removed from service and shipped offsite for further processing.

Article content

Total expected LOM uranium recovered is 18.28 Mlb eU3O8 over the 13-year operating life for an annual average production rate of 1.4 Mlb eU3O8 (assumed to be 99% payable).

Article content

The key planned design criteria are summarized below.

Article content

Table 4: Cebolleta Process Design Criteria

Article content

| Parameter | Units | Design | Source |

| Daily throughput | stpd | 2,300 | Assumed |

| Annual throughput | stpa | 839,500 | Calculated |

| U3O8head grade, design | % | 0.140 | Calculated |

| U3O8head grade, LOM | % | 0.110 | Calculated |

| Heap leach recovery | % | 80 | Assumed |

| U3O8production – Stacked Short Tons per Day | stpa | 2,290 | Calculated |

| U3O8production – Average Annual Recovered Metal | Mlb/annum | 1.4 | Calculated |

| U3O8production – Average Daily Recovered Metal | lb/day | 3,800 | Calculated |

| ROM moisture | % | 3 | Assumed |

| Mineralized material specific gravity | 3 | Assumed | |

| Mineralized Heap Leach bulk density | lb/ft3 | 99.88 | Assumed |

| Crushing | 2 stage mobile crusher | Assumed | |

| Crusher P80 | in | 2 | Assumed |

| Heap leach stacking time | hours/day | 10 | Assumed |

| Heap leach pad dimensions | |||

| Pad height | ft | 26.2 | Assumed |

| Irrigation rate | gpm/ft2 | 0.004 | Assumed |

| Heap Leach Time | Days | 90 | Assumed |

| Overall heap leach pad mass | st | 299,000 | Calculated |

| Heap leach pad application mass | st | 207,000 | Calculated |

| Heap leach pad area | ft2 | 228,164 | Calculated |

| Heap leach application area | ft2 | 157,960 | Calculated |

| Acid Concentration | % | 98 | Assumed |

| Leach solution H2SO4Concentration | lb/gal | 0.05 | Assumed |

| Pregnant solution flowrate | gpm | 646 | Calculated |

| Evaporation | % | 7% | Assumed |

| Uranium pregnant solution concentration | mg/L | 664 | Calculated |

| Ion exchange column volume | ft3 | 530 | Assumed |

| Resin bed depth, height | ft | 10.8 | Calculated |

| Column diameter | ft | 8.3 | Calculated |

| Number of columns | 4 (2 online, 2 standby) | Calculated | |

| Bed volumes per hour | BV/hr | 10 | Calculated |

| Uranium loading capacity | g U3O8per litre resin | 30 | Assumed |

| Loaded resin volume per day | st | 11 | Calculated |

| Number of columns taken out of service per day | Columns/d | 1.0 | Calculated |

| Number of columns inventory | 21 | Assumed | |

| Loading pH | 1.5 – 2.5 | Assumed | |

| Operating temperature | Ambient | Ambient (20 – 40C) | Assumed |

| Pressure drop across column | bar | 0.5 – 1 | Assumed |

Article content

Article content

Figure 2: Payable eU3O8 LOM Production Schedule

Article content

Article content

Article content

Article content

Project Infrastructure Overview

Article content

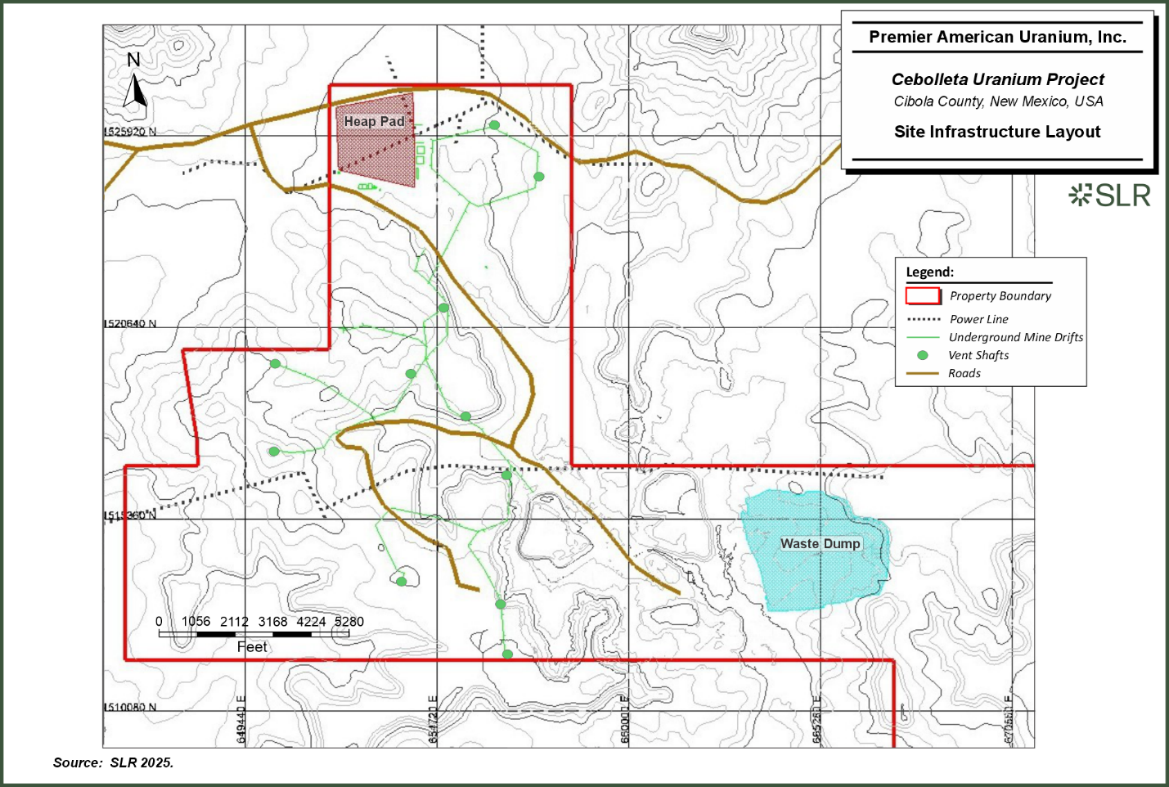

Current Project access is considered very good and the PEA includes upgrading for commercial operations. The Project will require an HLP, a resin-in-column processing plant, and standard surface facilities to support mining and processing operations.

Article content

The HLP and associated pond will be synthetically lined so that the solution is contained within a closed system, with the only net solution loss being to evaporation (designed as a zero-discharge facility). An appropriate location on site has been identified that meets the capacity requirements and other constraints, as shown below. The HLP construction is staged throughout the Project life to reduce up-front capital costs.

Article content

The Project will have line power and diesel-generated backup electric power for the processing plant, underground operation, ventilation fans, and surface infrastructure.

Article content

The general site layout, including placement of the heap leach pad, waste dump, power lines, roads, underground drifts and vent shafts are depicted below.

Article content

Article content

Figure 3: Site Infrastructure Layout

Article content

Article content

Article content

Article content

Key Recommendations of the PEA

Article content

Given the favourable technical and economic results of the PEA, the independent technical consultants preparing the PEA and Technical Report have recommended a multi-phase plan to further de-risk and refine project scope and economics, including advanced metallurgical test work to investigate and enhance leach recovery assumptions and assess other opportunities for optimization identified within the PEA. Recommendations also include drilling of core holes for confirmation and to provide sample material for leach tests, among a broader scope of work, ultimately supporting a recommendation to pursue a PEA update or Preliminary Feasibility Study.

Article content

Technical Report

Article content

The effective date of the PEA and the MRE is May 15, 2025, and the Technical Report will be filed on the Company’s website and under its SEDAR+ profile within 45 days of this news release.

Article content

When available, readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Article content

About the Cebolleta Uranium Project and Mineral Resources

Article content

Located in New Mexico, the Cebolleta Uranium Project is a past-producing property with extensive historical work and infrastructure. Its location in one of the premier uranium districts in the US provides strategic advantages, including proximity to utilities and existing processing facilities.

Article content

Qualified Person

Article content

The scientific and technical information contained in this news release relating to the PEA and MRE was reviewed and approved by Mr. Mark B. Mathisen, C.P.G., Stuart Collins, P.E., Jeffrey L. Woods, MMSA QP, Lee (Pat) Gochnour, MMSA QP and Matthew Behling, P.E., for SLR International Corporation, the authors of the Current Technical Report, each of whom is a “Qualified Person” (as defined in NI 43-101).

Article content

Mr. Mathisen (QP) has verified the exploration, sampling, analytical, and test data supporting the Technical Report through review and audit of historical and recent databases, comparison with original geophysical logs and assay records, and inspection of drill hole collar, interval, and grade data for completeness and accuracy. Verification included a site visit on September 12, 2023, review of drilling and downhole logging procedures, and evaluation of the 2023 twin-hole and 2025 Willie P database audits, which confirmed strong correlation with historical results and overall data reliability. Although no historical core or quality assurance/quality control reference materials are available and most legacy holes lack deviation surveys, no limitations were placed upon the QP during the verification process, and the QP considers the verification methods and resulting database adequate for Mineral Resource estimation and compliant with NI 43-101 requirements.

Article content

Article content

Additional scientific and technical information in this news release not specific to the PEA and MRE has been reviewed and approved by Dean T. Wilton, PG, CPG, MAIG, a consultant of Premier American Uranium Inc. , who is a “Qualified Person” (as defined in NI 43-101).

Article content

About Premier American Uranium Inc.

Article content

Premier American Uranium is focused on consolidating, exploring, and developing uranium projects across the United States to strengthen domestic energy security and advance the transition to clean energy. The Company’s extensive land position spans five of the nation’s top uranium districts, with active work programs underway in New Mexico’s Grants Mineral Belt and Wyoming’s Great Divide and Powder River Basins.

Article content

Backed by strategic partners including Sachem Cove Partners, IsoEnergy Ltd., Mega Uranium Ltd., and other leading institutional investors, PUR is advancing a portfolio supported by defined resources and high-priority exploration and development targets. Led by a distinguished team with deep expertise in uranium exploration, development, permitting, operations, and uranium-focused M&A, the Company is well positioned as a key player in advancing the U.S. uranium sector.

Article content

Article content

For More Information, Please Contact:

Article content

Premier American Uranium Inc.

Colin Healey, CEO and Director

[email protected]

Toll-Free: 1-833-223-4673

X: @PremierAUranium

www.premierur.com

Article content

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Article content

Non-GAAP Financial Measures

Article content

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS“). Such non-GAAP performance measures, including operating costs and free cash flow, are included because it understands that investors use this information to determine the Company’s ability to generate earnings and cash flows. The Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of mines to generate cash flows. Non-GAAP financial measures should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and are not necessarily indicative of cash flows presented under IFRS. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies.

Article content

Cautionary Statement Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, statements with respect to, the economic and scoping-level parameters of the PEA and the Project; the anticipated timeline for completion of the Technical Report; mineral resource estimates; the cost and timing of any development of the Project; the proposed mine plan and mining methods; dilution and mining recoveries; processing method and rates; production rates; projected metallurgical recovery rates; infrastructure requirements; energy sources; capital and operating cost estimates; the projected LOM and other expected attributes of the Project; the NPV, IRR and payback period of capital; the uranium industry and uranium prices; government regulations and permitting; access to the Project; water sources and management; estimates of reclamation obligations and closure costs; requirements for additional capital; expectations with respect to project development and permitting, construction and operational processes; availability of services to be provided by third parties; future development methods and plans; and other activities, events or developments that are expected, anticipated or may occur in the future. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Article content

Article content

Forward-looking information and statements are based on our current expectations, beliefs, assumptions, estimates and forecasts about PUR’s business and the industry and markets in which it operates. Such forward-information and statements are based on numerous assumptions, including among others, general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by PUR in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Article content

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of Premier American Uranium to differ materially from any projections of results, performances and achievements of Premier American Uranium expressed or implied by such forward-looking information or statements, including, among others: risks related to the inherent uncertainties regarding cost estimates; changes in commodity and metal prices; results of future exploration activities; cost overruns; the limited operating history of the Company; negative operating cash flow and dependence on third party financing; uncertainty of additional financing; delays or failure to obtain required permits and regulatory approvals; changes in mineral resources; no known mineral reserves; aboriginal title and consultation issues; reliance on key management and other personnel; potential downturns in economic conditions; availability of third party contractors; availability of equipment and supplies; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry; changes in laws and regulation, competition, and uninsurable risks and the risk factors with respect to Premier American Uranium set out in PUR’s annual information form for the year ended December 31, 2024 and the other documents of PUR filed with the Canadian securities regulators and available under PUR’s profile on SEDAR+ at www.sedarplus.ca.

Article content

Article content

Although PUR has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. PUR undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities law.

Article content

Images accompanying this announcement are available at

Article content

Article content

Article content

Article content

Article content

Article content

Article content

Article content

Article content

Article content

.jpg) 22 hours ago

3

22 hours ago

3

English (US)

English (US)