Article content

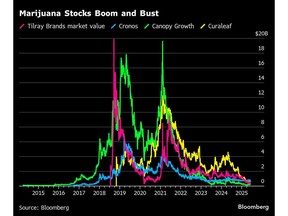

(Bloomberg) — The stock market’s marijuana boom is over. And for the once high-flying cannabis industry, a euphoric dream of never-ending growth has turned into a survival nightmare as it navigates through the bust.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The comedown has been brutal, with the largest exchange-traded fund tracking the legal weed industry, the AdvisorShares Pure US Cannabis ETF, trading for around $2.37, down 96% from the closing high of $55.05 it hit in February 2021. But the reason it happened is pretty simple.

Article content

Article content

Article content

The business kicked into gear in 2018 when Canada legalized marijuana for recreational use, with the US expected to follow along shortly. Wall Street bankers assumed they were living through the end of America’s second Prohibition and they were determined to cash in.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

But while a few dozen US states legalized weed, the push for a national law largely stalled out. Now, some states, like Texas, are ready to ban all recreational weed products. And with President Donald Trump in the White House, the likelihood of America legalizing pot nationally anytime soon seems remote.

Article content

“There’s been this carrot that’s been dangling in front of this industry for so long, and it’s been a mirage,” Roth Capital Partners analyst Bill Kirk said in an interview. “If the carrot’s there, it’s rotten at this point. No one’s chasing it anymore, no one believes it’s going to come to pass.

Article content

In Canada, where the industry is primarily located, the pain is particularly acute. Tilray Brands Inc. had a market capitalization of almost $20 billion in 2018 shortly after the Ontario-based cannabis producer went public. It’s now less than $500 million.

Article content

Article content

The company’s US-listed stock, which hit an intraday high of $300 on Sept. 19, 2018, is trading for around 40 cents. And its Canadian-listed shares are the worst performers in the S&P/TSX Composite Index this year, losing 71%. S&P Dow Jones Indices announced on Friday that the Canadian shares would be removed from the benchmark in late June.

Article content

‘Growth Didn’t Materialize’

Article content

The situation has gotten so dire that Tilray shareholders are set to vote for a reverse stock split of between a 1-for-10 and 1-for-20 on Tuesday just to get the company’s US share price back above $1 and maintain its listing on Nasdaq.

Article content

“It was a hype, I mean it’s obviously unsustainable,” said Frederico Gomes, an analyst at ATB Securities. “That growth did not materialize, it didn’t materialize in Canada, it didn’t materialize in the US because people were also expecting that it would get a movement in terms of legalizing cannabis in the US that did not happen. And it hasn’t really happened as well in the international markets.”

Article content

The lower equity valuations are justified due to the weak fundamentals and the companies’ lack of growth and poor prospects ahead, Morningstar Investment analyst Kristoffer Inton said in an interview.

.jpg) 3 hours ago

3

3 hours ago

3

English (US)

English (US)