Article content

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A funny thing has been happening to the Canadian dollar lately.

Article content

Article content

Despite evidence that the economy is weakening, the currency has been going up, not down, rising 3 per cent against the U.S. dollar since President Donald Trump‘s Liberation Day.

Article content

That’s not usually how it works, but some strategists think this is more than just a temporary overshoot.

Article content

Desjardins Group expects the divergence will continue to widen in coming months, with the loonie rising to 74 cents U.S. by the end of this year and to almost 77 cents U.S. by the end of the next. It was trading up at 73.08 this morning.

Article content

Article content

The forecast is based on the U.S. dollar losing strength rather than the Canadian dollar gaining it, said Mirza Shaheryar Baig, a foreign exchange strategist with Desjardins. The loonie’s performance against other major currencies has not been stellar.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Net-net, a strong loonie is the result of a shift in global capital flows leading to a broadly weaker U.S. dollar,” he said.

Article content

Since Liberation Day the U.S. dollar has become positively correlated with stocks.

Article content

“In other words, it has lost its safe haven appeal. This matters because many Canadian institutional investors who did not hedge the currency risk on their U.S. investments are now being forced to raise their hedge ratios,” said Shaheryar Baig.

Article content

The outlook for the U.S. economy is also weakening. Coming out of the pandemic, it grew faster than other economies, but that has changed. Expectations for U.S. growth have dropped and are now in line with other advanced economies, he said.

Article content

The Organisation for Economic Co-operation and Development warned last week that Trump’s tariff war will sap global growth in 2025 and it gave the United States the biggest downgrade among G7 nations. The OECD sees its growth slowing sharply from 2.8 per cent in 2024 to 1.6 per cent this year, and 1.5 per cent next.

Article content

Article content

Trump’s tactics to raise the income share of American workers is also unnerving investors, said Shaheryar Baig. Telling Walmart Inc. “to eat the tariffs” and threatening Apple Inc. with duties on products made out of the country does not help boost the profits investors are looking for.

Article content

Article content

“To many investors, American capitalism now resembles Chinese ‘common prosperity,'” he said.

Article content

Desjardins admits its forecast has risks. America dodged a widely expected recession in 2023 and its economy could surprise again. Carry trade in the U.S. dollar, which has the highest deposit yields in the G7, could also revive, he said.

Article content

The downside of a strong Canadian dollar against the greenback is that it makes exports more expensive, a drag on Canada’s already fragile economy.

Article content

Desjardins believes this will force the Bank of Canada to cut its interest rate another 75 basis points to 2 per cent this year.

Article content

Article content

Sign up here to get Posthaste delivered straight to your inbox.

Article content

Article content

Article content

Article content

Article content

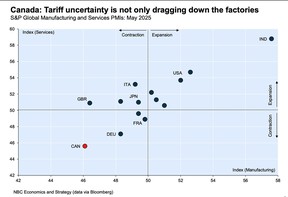

Canada’s manufacturing sector has been slammed by tariffs, but now new data shows that services, which makes up a much bigger share of the economy, are suffering too.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)