Article content

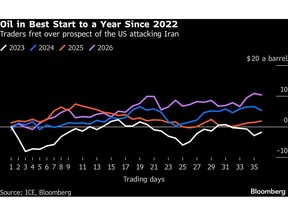

(Bloomberg) — The oil market is in the middle of its strongest start to a year since 2022 as supply shocks and sanctions confound expectations of a glut. Now traders are racing to cover themselves against the prospect of the US bombing Iran again.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A surge in activity across futures and options markets is already pulling up crude prices — Brent futures touched a seven-month high of more than $72 a barrel on Friday, and some analysts see a risk premium of as much as $10.

Article content

Article content

Article content

The rally — Brent is up about 18% since the end of last year — represents a marked shift from just weeks ago, when traders were focused on forecasts for a record surplus, especially around now.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Instead, there’s been unexpected strength thanks to supply disruptions in the US and Kazakhstan — as well as a shunning of sanctioned crude. That’s been amplified by geopolitical risk — starting in Venezuela and extending to Iran — where President Donald Trump could order fresh strikes in a region home to about a quarter of the world’s seaborne oil trade.

Article content

“You have a potential war, and that’s the overriding factor, but it’s in addition to a much tighter market than people anticipated,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “I would fasten my seatbelt and wouldn’t want to be short in this market.”

Article content

Trump said in response to reporters’ questions on Friday that he’s considering a limited strike on Iran after amassing the biggest US force since 2003. Axios reported earlier in the week that a US attack on Iran could come sooner than expected and look more like a full-fledged war.

Article content

Article content

Futures Surge

Article content

The number of Brent oil futures held surged to an all-time high this year, while last month saw record trading in options to protect against a further rally. Volatility has surged to the highest since the US last bombed Iran in June, and traders have — for the longest period in years — been charging premiums to protect against a surge.

Article content

“It does feel that the probability of limited strikes and limited retaliatory strikes from Iran seems less likely this time around,” said Jorge Leon, head of geopolitical analysis at consultant Rystad Energy AS. “It worked last year, but right now I have the feeling it’s a nuclear deal, or a wider escalation, not something in the middle.”

Article content

That prices haven’t pushed higher is a sign of how much global output has expanded.

Article content

US Energy Secretary Chris Wright even said this week that American energy dominance has made the country’s foreign policy less beholden to supply shocks.

Article content

The Organization of the Petroleum Exporting Countries and its allies steadily lifted output last year. Likewise, volumes from outside the group also hit a record, leaving global production at 108 million barrels a day at the end of 2025, according to IEA estimates. That’s almost 3 million barrels a day higher than consumption over the same period, its figures show.

.jpg) 1 hour ago

4

1 hour ago

4

English (US)

English (US)